MoeGo Capital provides essential funding to drive growth and expansion with no hidden fees or lengthy applications to fill out. Upon approval, you can receive your funds as soon as the next business day — without further delay, you can invest funds in equipment, expand business services, and manage seasonal fluctuations.

MoeGo Capital is committed to delivering value and care to business owners by offering a fast, flexible, and reliable financing solution. We are here to back up your need to seize opportunities and achieve lasting success in the pet grooming and care business.

MoeGo Capital Key Benefit

- Quick Access To Funds: Address immediate business needs without delay. Loans are approved and disbursed within just two business days.

- Flexible Loan Options: Choose the financing solution that best suits your needs, whether through our traditional Merchant Cash Advance or the new Term Loan.

- Fast And Simple Application: Benefit from a streamlined loan application process integrated within MoeGo, making it convenient and hassle-free.

- Transparent And Clear Pricing: Know exactly how much to pay upfront, offering straightforward pricing with no hidden fees or surprises.

- Data-Driven Insights: Ensure the loan aligns with business revenue trends and supports sustainable growth.

MoeGo Capital Application

1.Who can apply

Only businesses in the US with MoeGo Pay will receive a pre-qualified offer if available, which will be valid for 30 days.

- Non-US user: The loan offer is not available for users outside of the US but please stay tuned!

- Non-MoeGo Pay user: Go to the Payment section to get started with MoeGo Pay now.

- Eligible MoeGo Pay user: Can < See my offer > in the Finance section.

2.How to be eligible

Eligibility for a MoeGo Capital loan is based on a variety of factors related to your business, including your payment processing volume, account history, outstanding debt balance, business expenses and income, payment frequency, and more.

We review business accounts on a regular basis and you’ll see pre-qualified offers under your finance dashboard when your business becomes eligible.

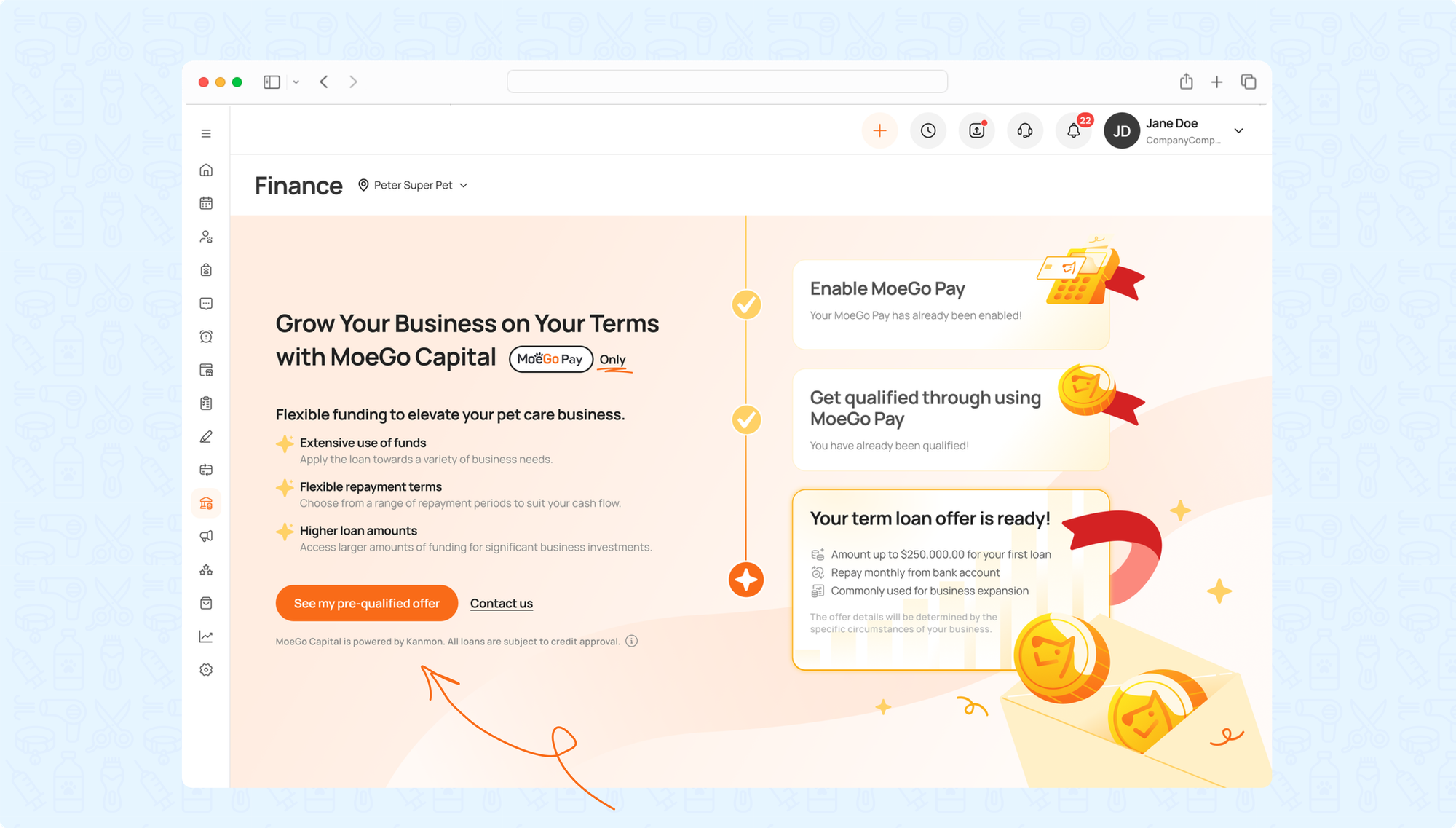

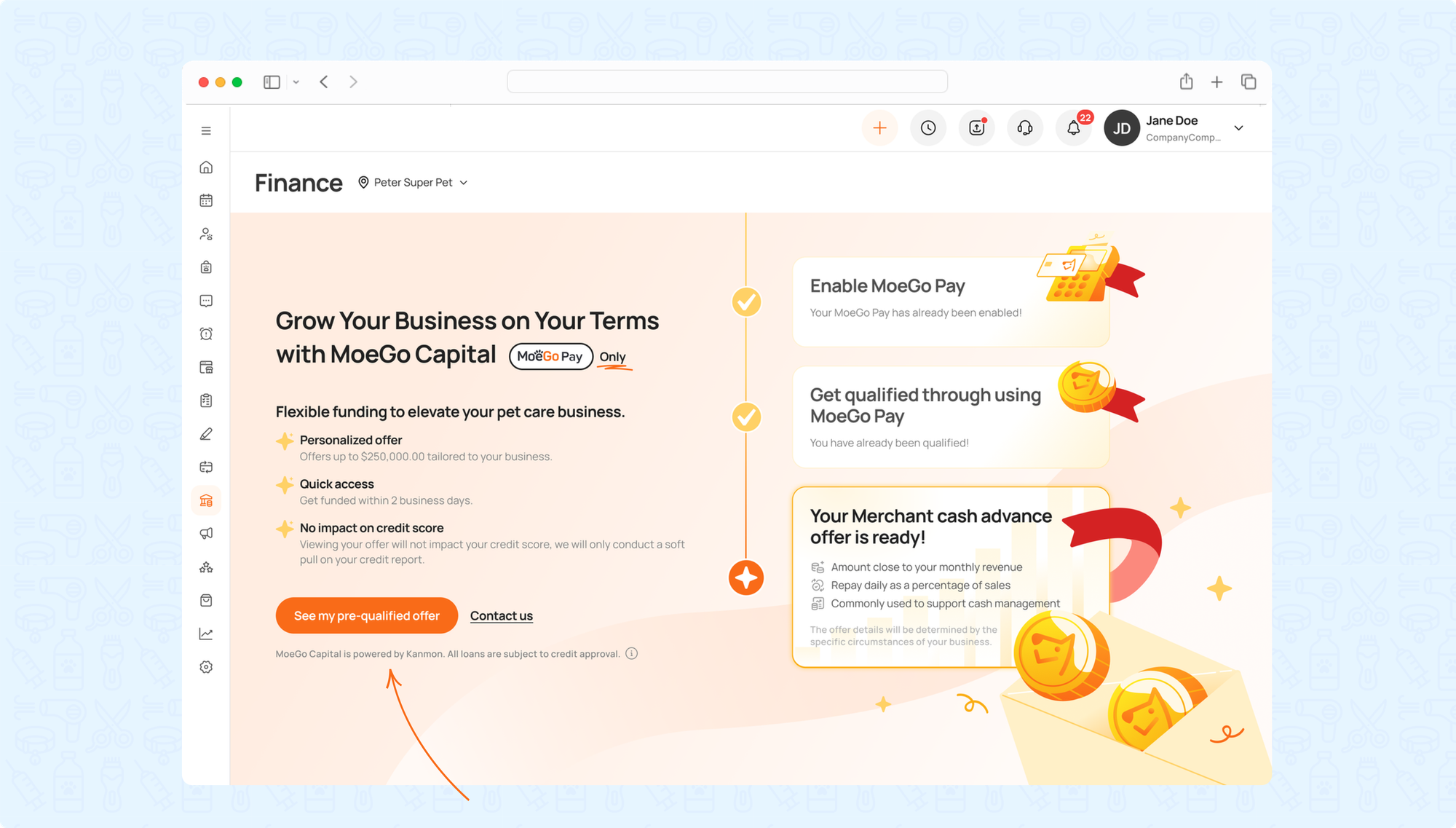

3.How to apply once eligible

Step 1: Go to < Finance > and click on < See my offer >

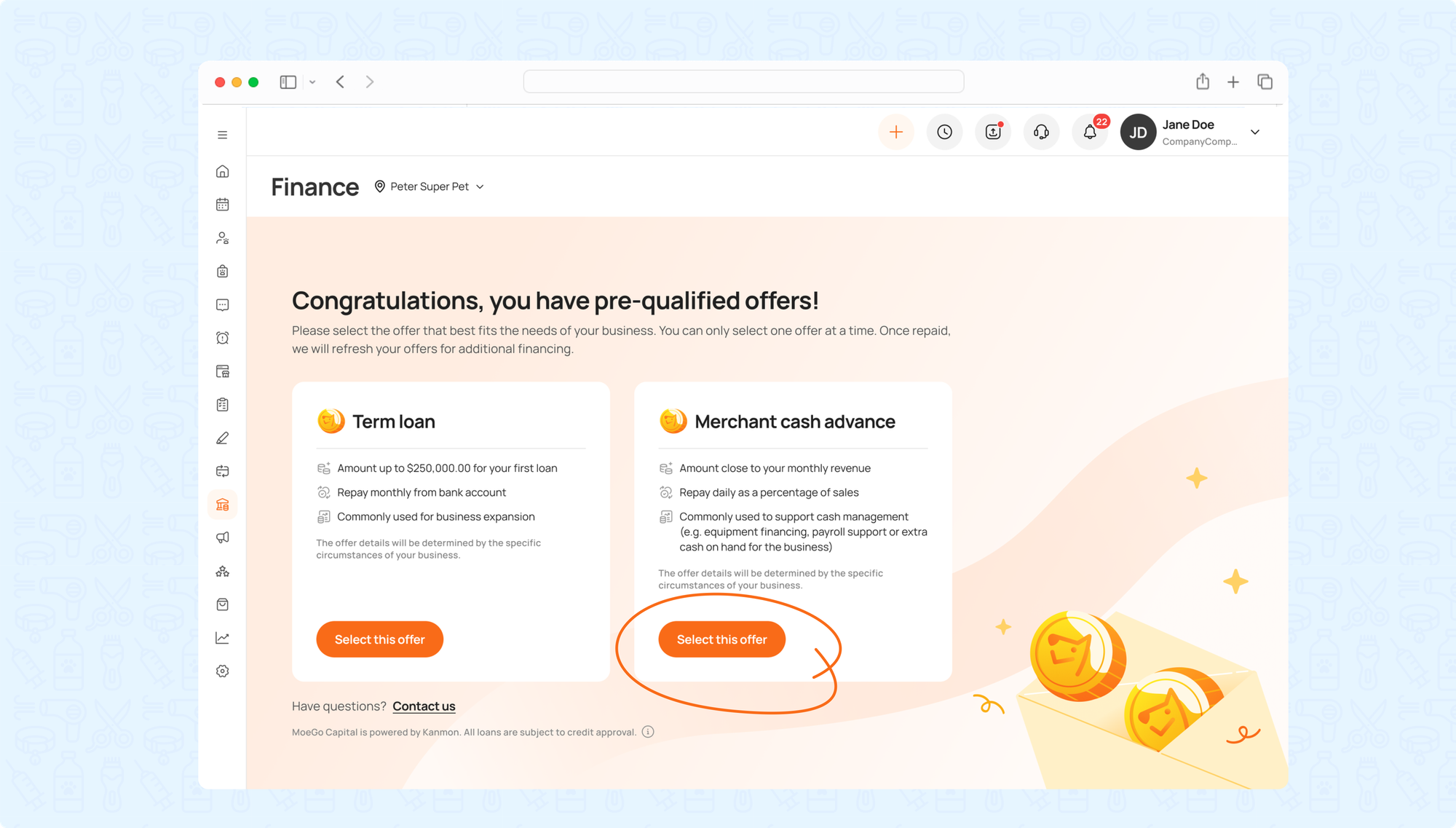

In some cases, you may have the option < Select this offer> to choose whether a Term Loan or a Merchant Cash Advance makes more sense for your business.

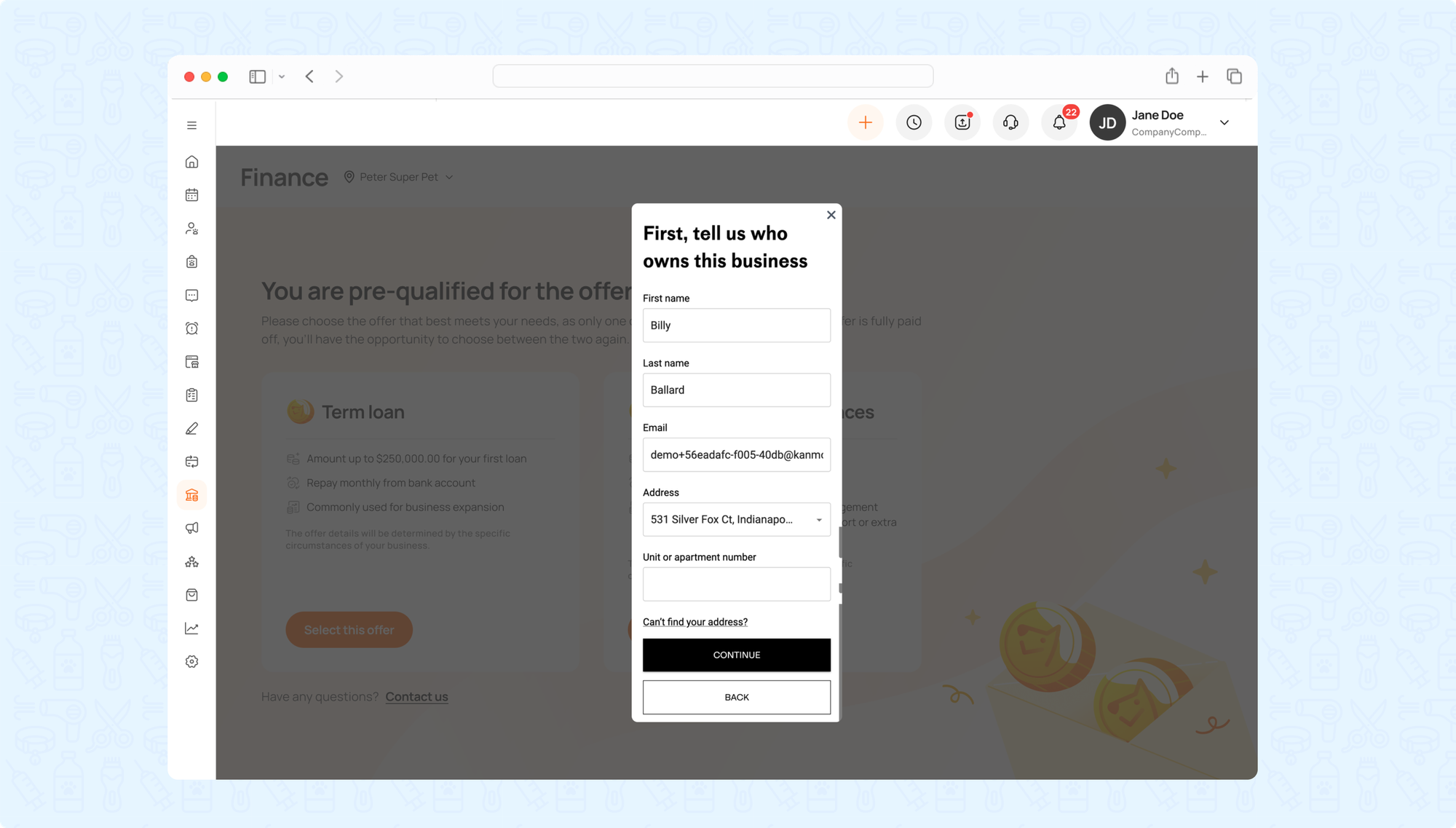

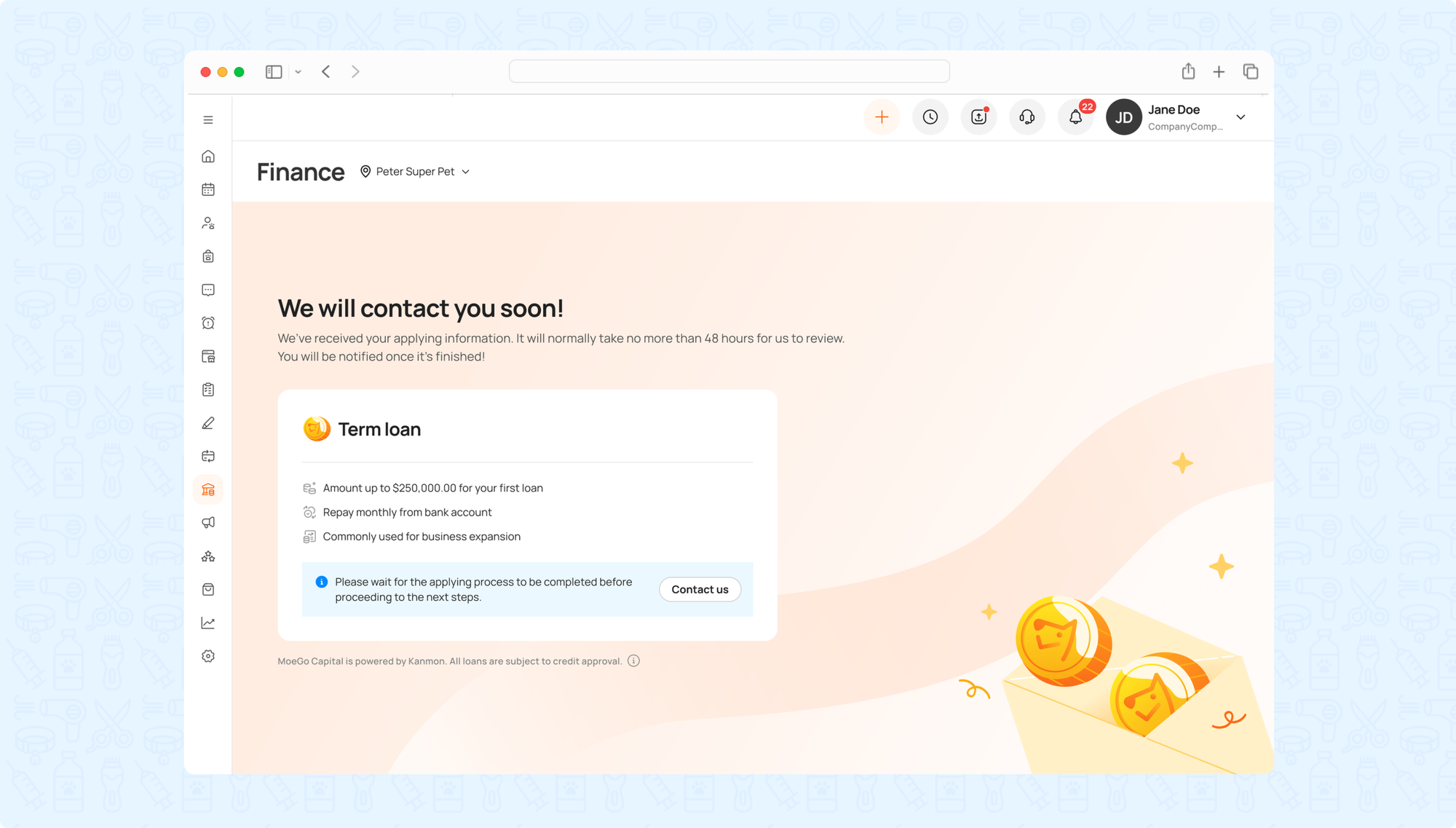

Step 2: Complete the information required for each step following the instructions

Step 3: Wait no more than 48 hours for the result of the application after submission.

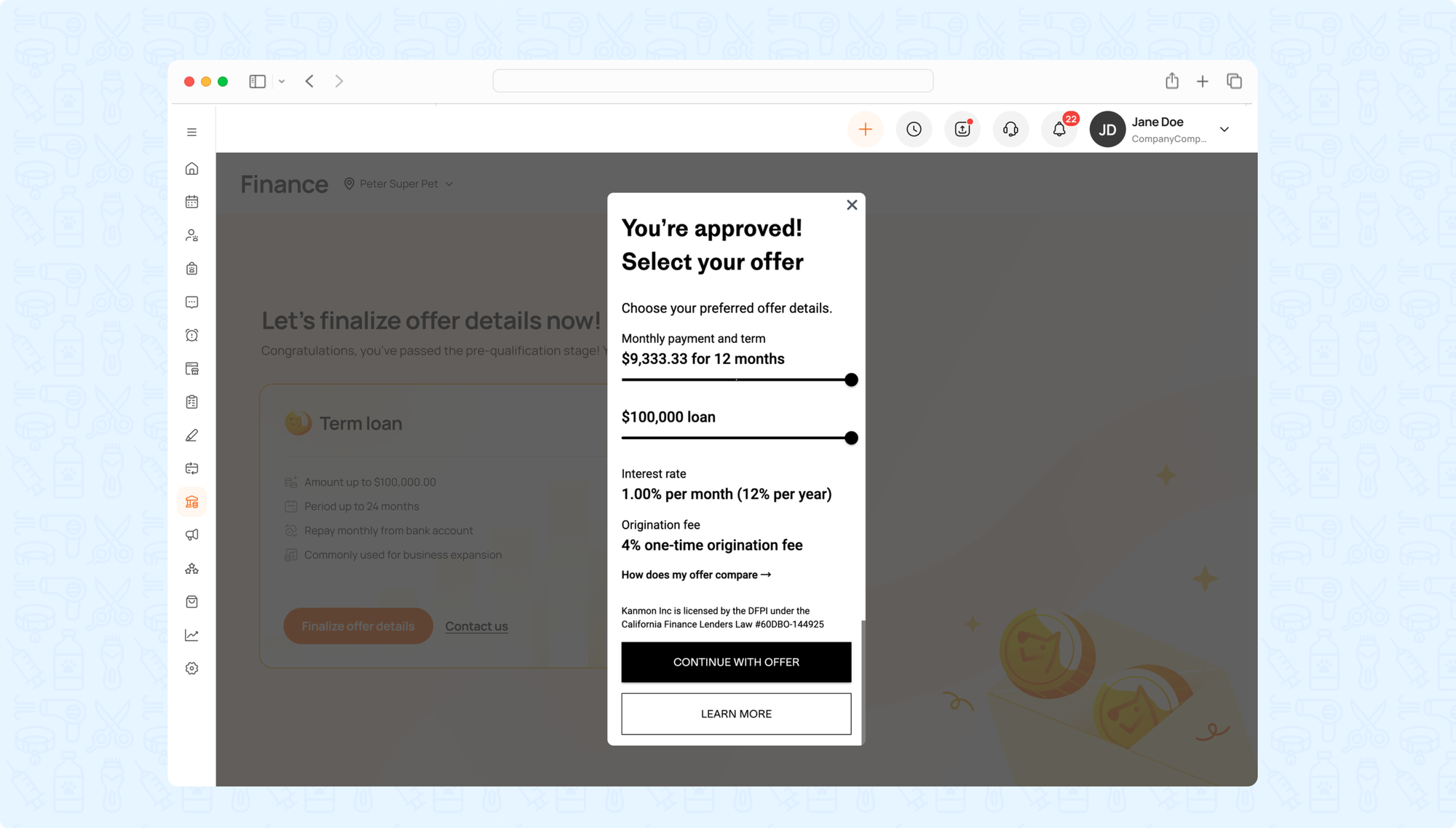

Step 4: Finalize offer details to select the offer term and amount. Then complete the details info to get the offer.

MoeGo Capital Deposit

If approved, the availability of funds depends on your bank’s processing speed, which can take up to three business days. (For more information about your bank’s processing speed, please contact your bank. )

If not approved, Kanmon will provide the reason why you did not qualify. (For more details, please contact Kanmon. )

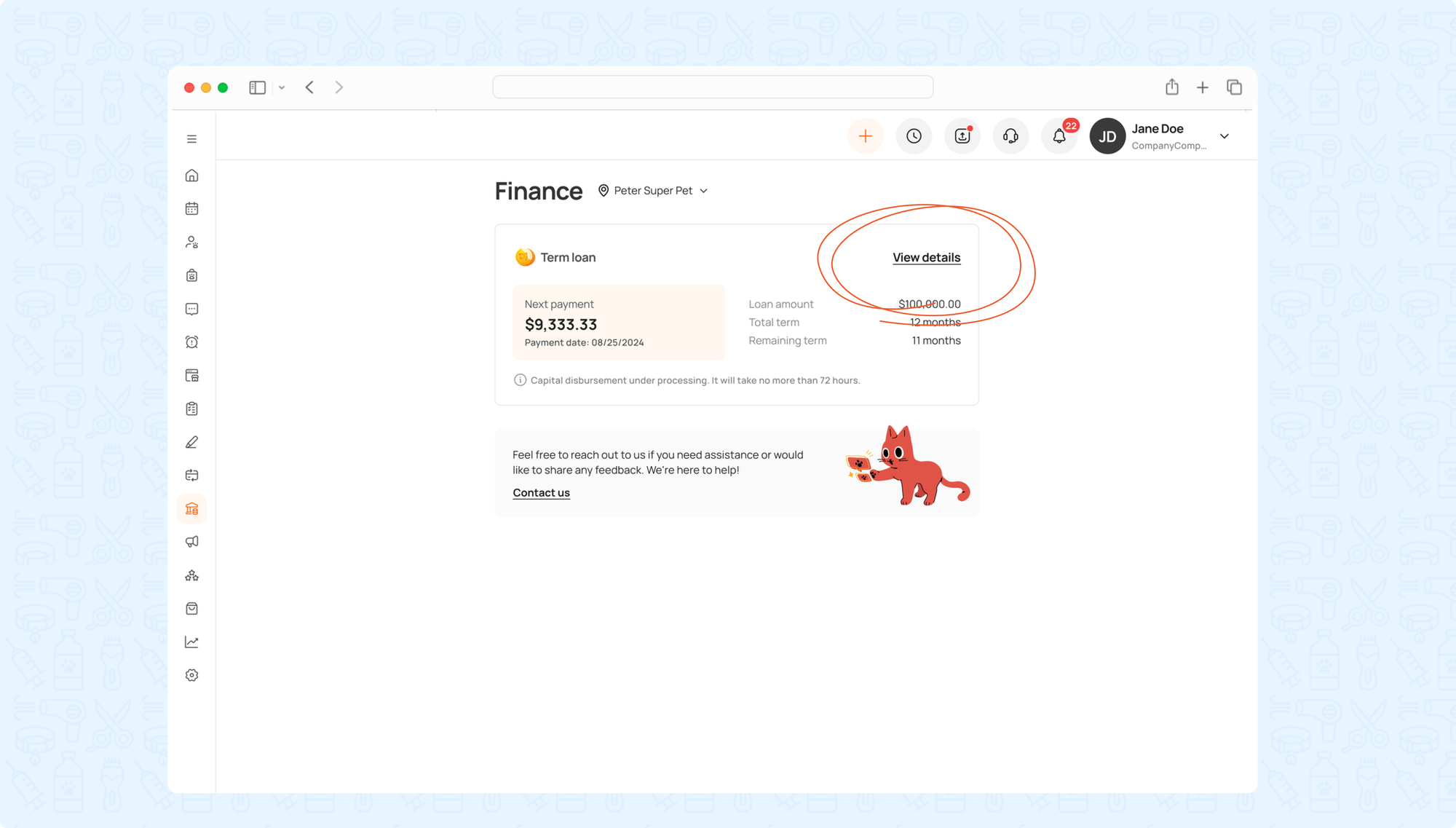

Go to your finance dashboard to < view details >.

You can track your outstanding balance, payment history, and other useful information in your financing dashboard. This information will begin to update as soon as you receive your funds.

MoeGo Capital Loans

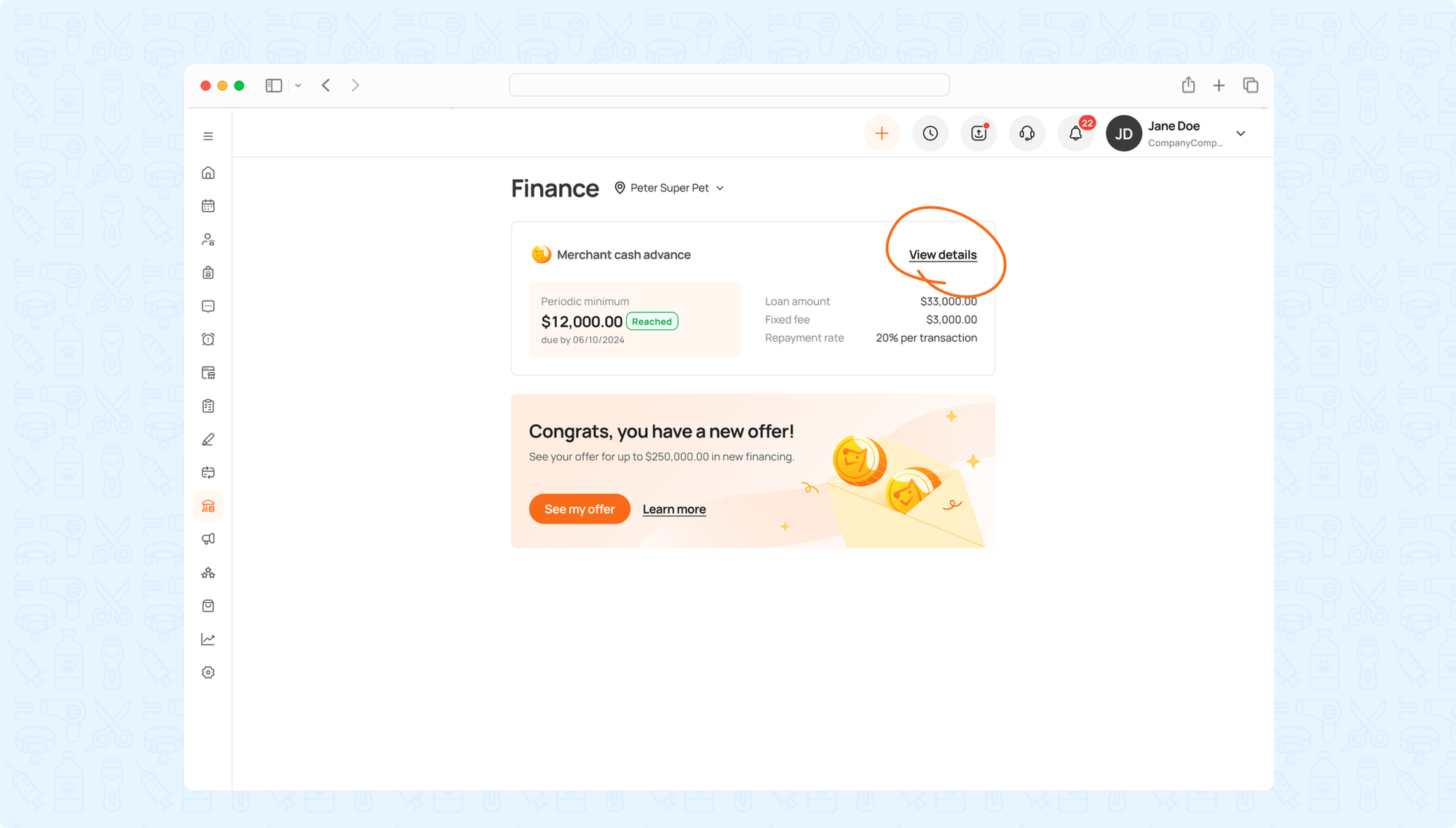

For businesses seeking the ultimate flexibility, Merchant Cash Advance is the one for you, with repayments automatically deducted as a percentage of daily sales.

For those who prefer predictability, the Term Loan offers fixed monthly payments that make cash flow planning more manageable.

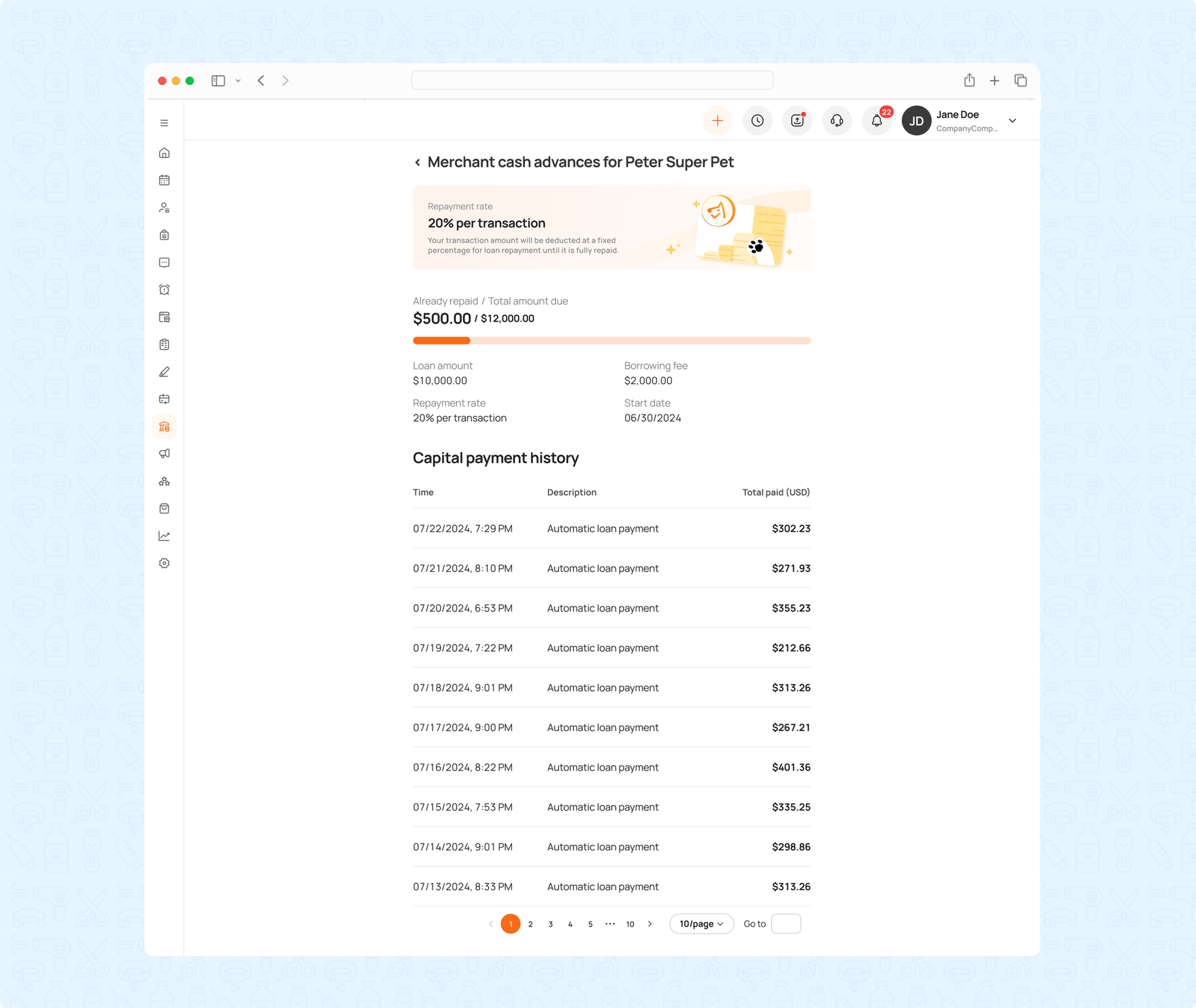

1.Merchant Cash Advance

Repayment as a percentage of daily sales

How repayments work

It will automatically get paid with a percentage of your sales through MoeGo. The fixed percentage you’ll pay out of sales is a part of your loan agreement.

Repayment details

You can review the following details on your financing dashboard:

- Already repaid: Amounts repaid to date

- Total amount due: Loan amount + borrowing fee

- Loan amount: The amount that has been deposited

- Borrowing fee: The fee paid for the loan

- Repayment rate: The percentage of each transaction that will be deducted automatically to pay back the loan

- Start date: the date when the loan agreement officially begins

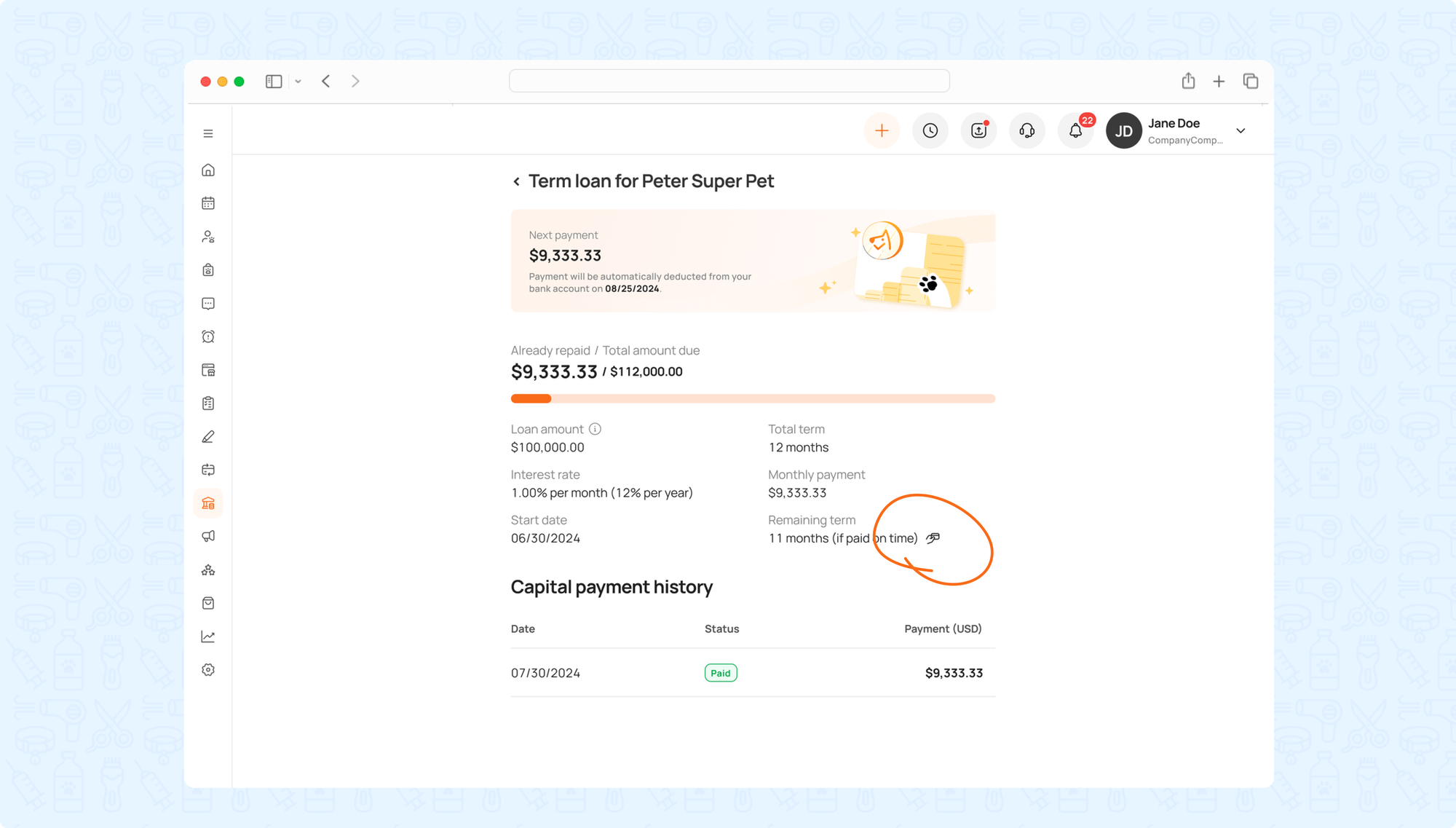

2.Term Loan

Fixed payments and set terms.

How repayments work

You will repay your loan with fixed, monthly payments. We will automatically deduct each payment from the business bank account you choose.

Repayment details

You can review the following details on your financing dashboard:

- Next payment: The upcoming payment date and amount

- Already paid: Amounts repaid to date

- Total amount due: Loan amount + Fixed fee

- Loan amount: The amount that has been deposited

- Total term: The loan duration

- Remaining term: the amount of months left until the loan is fully repaid.

- Interest rate: Applicable to the Term Loan

- Monthly payment: The fixed amount due each month

- Start date: The date when the loan agreement officially begins

MoeGo Capital is powered by Kanmon, which is integrated directly into the MoeGo finance dashboard, ensuring a seamless and hassle-free experience. On the same page, with one click to:

- Check loans details

- Review payment history

- Pay off loan early

- Download loan agreements

- Contact Kanmon support

Frequently Asked Questions

Q: Can I repay my loan early?

A: You can repay your Term Loan early at any time but cannot repay Merchant Cash Advance early.

Q: Are there any late fees?

A: There is a late charge for Term Loans but not with Merchant Cash Advances. There is a charge of a $25 fee for each late payment on the Term Loan and a $35 fee for each payment that returns due to insufficient funds in your business bank account.

Q: Does enrolling in the program affect my credit score?

A: No. We only conduct a soft pull of your credit report, which does not affect your personal credit score.

Q: Why do I need to provide my bank connection details?

A: Securely connecting your business bank account allows us to review your cash flow and determine your best loan offers.

Q: Why don't the numbers on my linked external bank account match?

A: We use Plaid to link your external bank account. Sometimes you might see what looks like random or incorrect account number information that does not match what you have on file with your bank. For security reasons, some financial institutions, such as Chase Bank, provide a tokenized version of your account information to us, to protect your account. This won’t affect your ability to receive funds or make any repayments. See Plaid’s help article on how this works, or contact your bank if you have any additional questions.

Q: Is collateral required to obtain a MoeGo Capital loan?

A: We require a personal guarantee on MoeGo Capital loans. For term loans, we also may take a security interest in your business assets and file a UCC statement with the Secretary of State where your business is registered.

Q: Can I consolidate my business loans with MoeGo?

A: Yes, consolidating or refinancing your business loans with MoeGo is simple and fast. When you sign up, you will be asked to provide details about your existing debt. We will use this information to evaluate your consolidation and refinancing options. Then, Kanmon's team will reach out to have a conversation with you about your best options. Please note that loan consolidation currently is only available for users looking for a term loan.

Q: What is a UCC filing?

A: A UCC-1 filing is a publicly available record that provides notice of a security interest in certain property of a debtor. UCC statements are typically filed with the Secretary of State where a business debtor is organized. UCC statements can be filed for several reasons. For example, UCC statements are sometimes filed when a lender makes a secured loan to a business. Please note that Kanmon does not file a UCC-1 in connection with merchant cash advances.

Q: Kanmon filed a UCC statement on my business in connection with my MoeGo Capital loan. How do I get it released?

A: After you have finished paying off your loan, you can reach out to Kanmon with a request to remove the UCC-1 filing. Please note that it can take up to 10 business days after repaying your loan for the lien termination to be filed. Once the lien termination is filed, it could also take additional time for the Secretary of State to process the termination and provide a UCC-3 termination statement.

Q: Can the loan balance be paid off via debit card?

A: No, loans powered by Kanmon cannot be repaid via debit card.

Read more about Kanmon here.

If you have any other questions about MoeGo Capital, feel free to contact Kanmon via email at help@kanmon.com or call/sms at 619-369-8151!