MoeGo Accounting is tailored for pet care businesses. Whether tracking everyday expenses or generating detailed financial reports, MoeGo Accounting simplifies financial management, eliminating manual errors and improving accuracy.

With MoeGo Accounting, business owners gain better financial insights and control, allowing them to focus more on growing their businesses and less on complex bookkeeping tasks.

MoeGo Accounting Key Benefits

Real-time financials within MoeGo

Close a ticket, and it's instantly recorded in accounting. Access detailed statements and track expenses - all in one place.

Stay on top of your financial

No more relying on bank balances to gauge your business health. With a dedicated MoeGo bookkeeper, keep your records accurate and organized.

Be prepared for tax season

No more last-minute scrambling. With full-service bookkeeping, your records stay tax-ready all year, making filing seamless and stress-free.

MoeGo Accounting Advanced Features

MoeGo Accounting provides an intuitive, automated, and reliable accounting experience and helps pet service businesses operate more efficiently.

- Automated Transaction Categorization

All transactions made within the MoeGo platform are automatically classified according to an accounting standard chart of accounts. This categorization adheres to generally accepted accounting principles (GAAP), ensuring that every expense, payment, and revenue entry is accurately tracked and categorized. For example:

- Payments received for grooming services are categorized under "Service Revenue."

- Purchases of pet care supplies are listed under "Operating Expenses."

This automation reduces the need for manual bookkeeping and ensures an organized, standardized financial structure. Imagine no longer having to manually sort through hundreds of transactions at the end of the month—MoeGo Accounting does it for you, freeing up hours of administrative time.

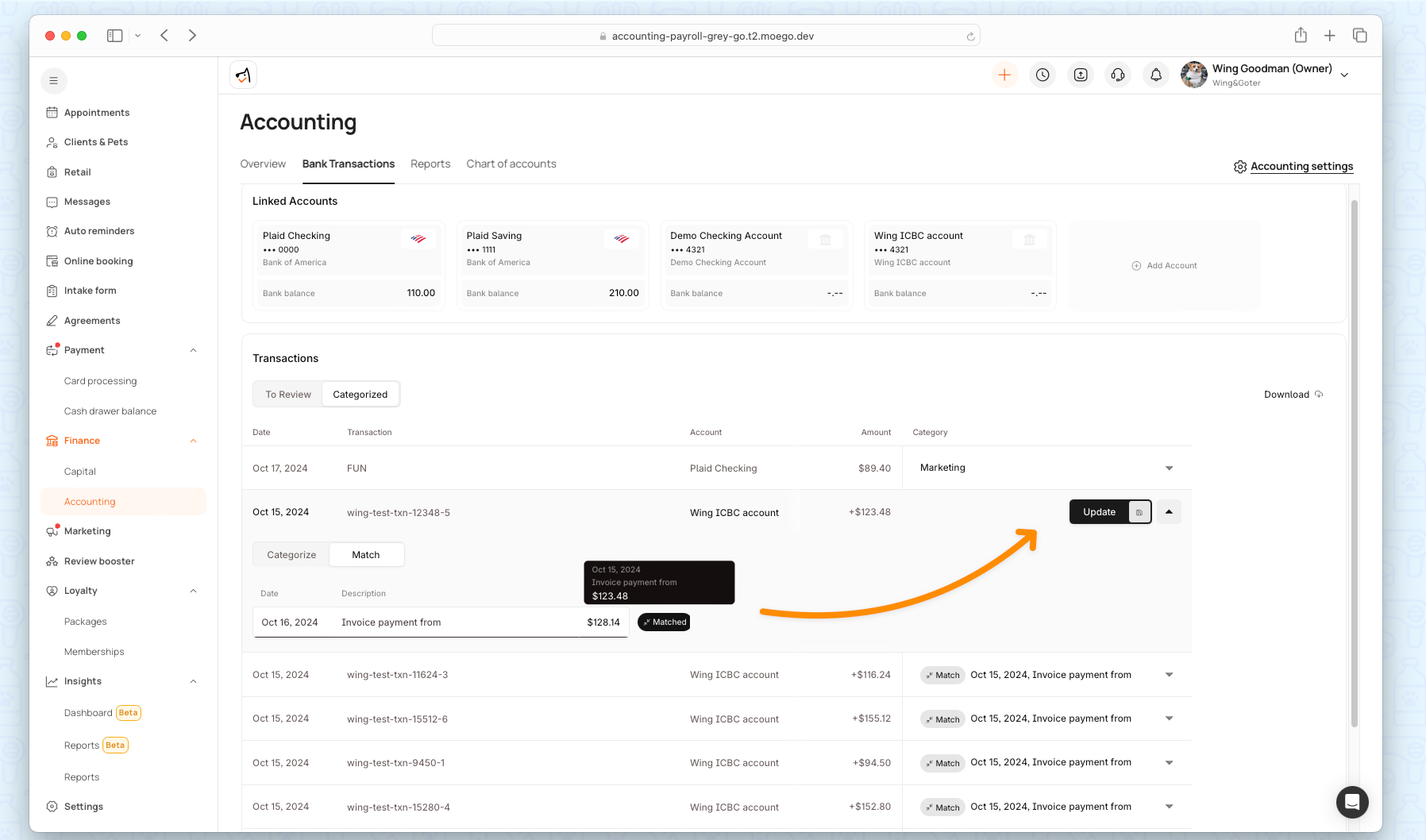

- Seamless Invoice and Bank Transaction Matching

MoeGo Accounting automatically matches invoice payments with corresponding bank transactions, making reconciliation effortless. This means when a customer pays for a grooming service, the payment is automatically linked to the correct invoice and reflected in the bank account.

For example, if a $100 payment for a grooming service is recorded, MoeGo Accounting identifies the matching bank transaction, ensuring there are no discrepancies. This reduces the risk of manual errors and gives business owners peace of mind, knowing their financial data is always accurate and up-to-date.

MoeGo Accounting Availability

- Available for MoeGo users on all plans.

- Available on both desktop and mobile app, allowing you to manage your finances wherever you are.

MoeGo Accounting Subscription

Navigate to the Finance section > Accounting to check the plan.

Once subscribed, you can connect your account to start using the accounting module!

Get Started With MoeGo Accounting

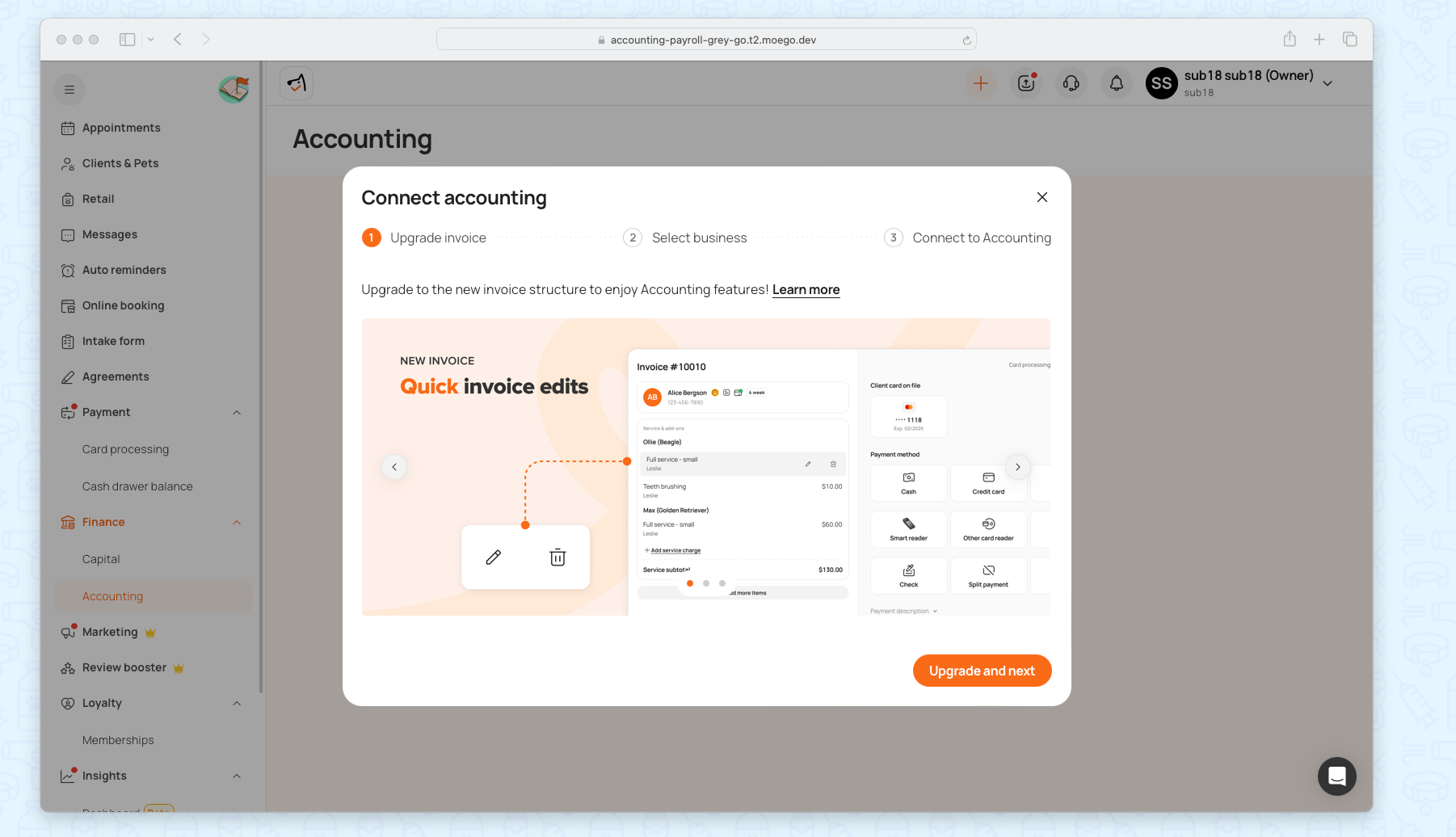

Step 1: Upgrade To New Invoice

Simply click "Upgrade and Next" to upgrade to the new invoice system.

This upgrade integrates the new accounting features directly into your invoicing workflow. For more details on new invoices, feel free to visit MoeGo Pay - Revamped Payment Experience.

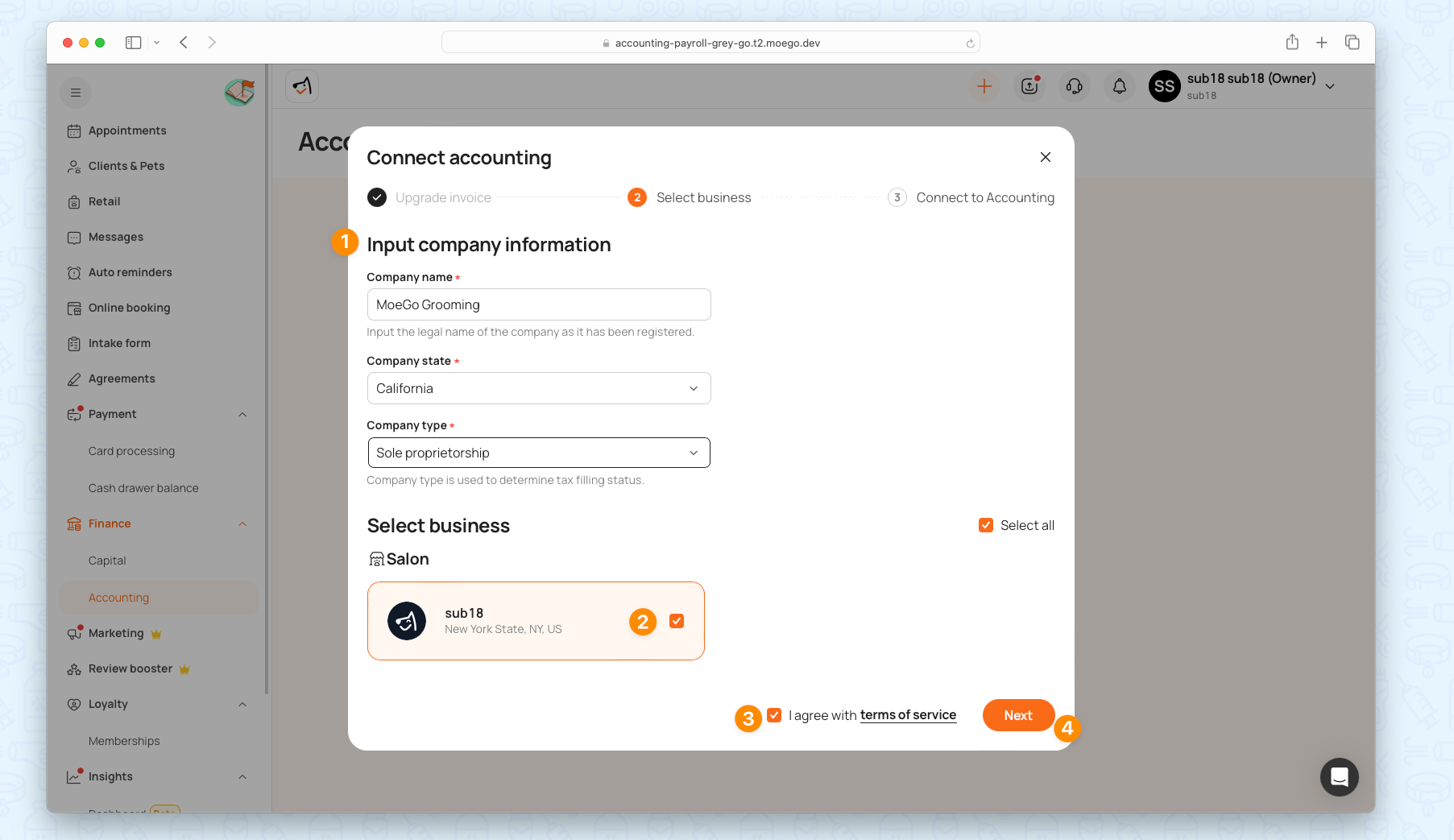

Step 2: Select Business

For multi-location businesses, MoeGo allows you to select which location to link to the accounting module.

- Input company information:

- Company name: Input the legal name of the company as it has been registered.

- Company state: Select the state in which the company has been registered.

- Company type: Company type is used to determine tax filing status.

- Select business

- Accept and check on < Terms of service >

- Click on < Next > to proceed

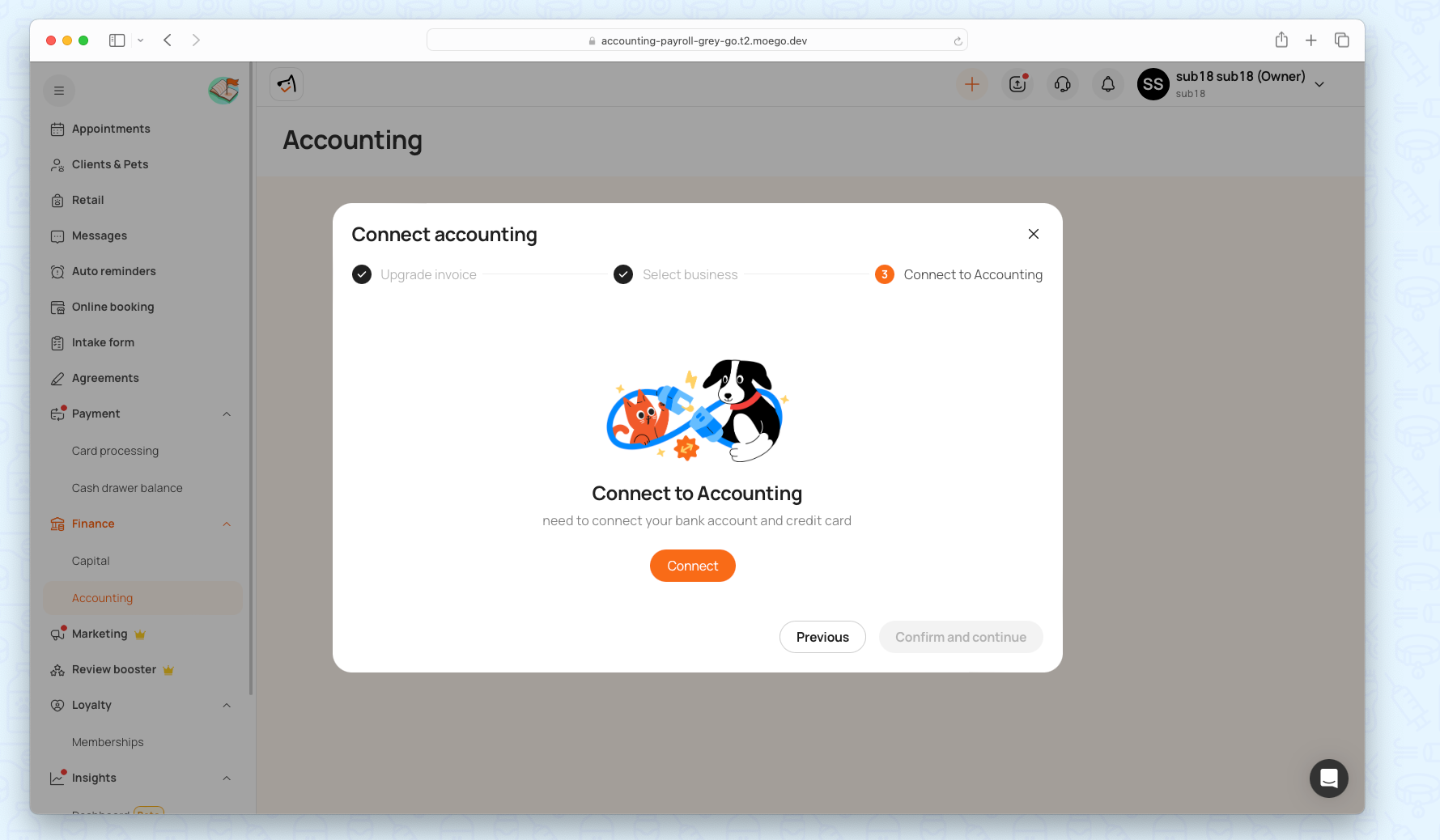

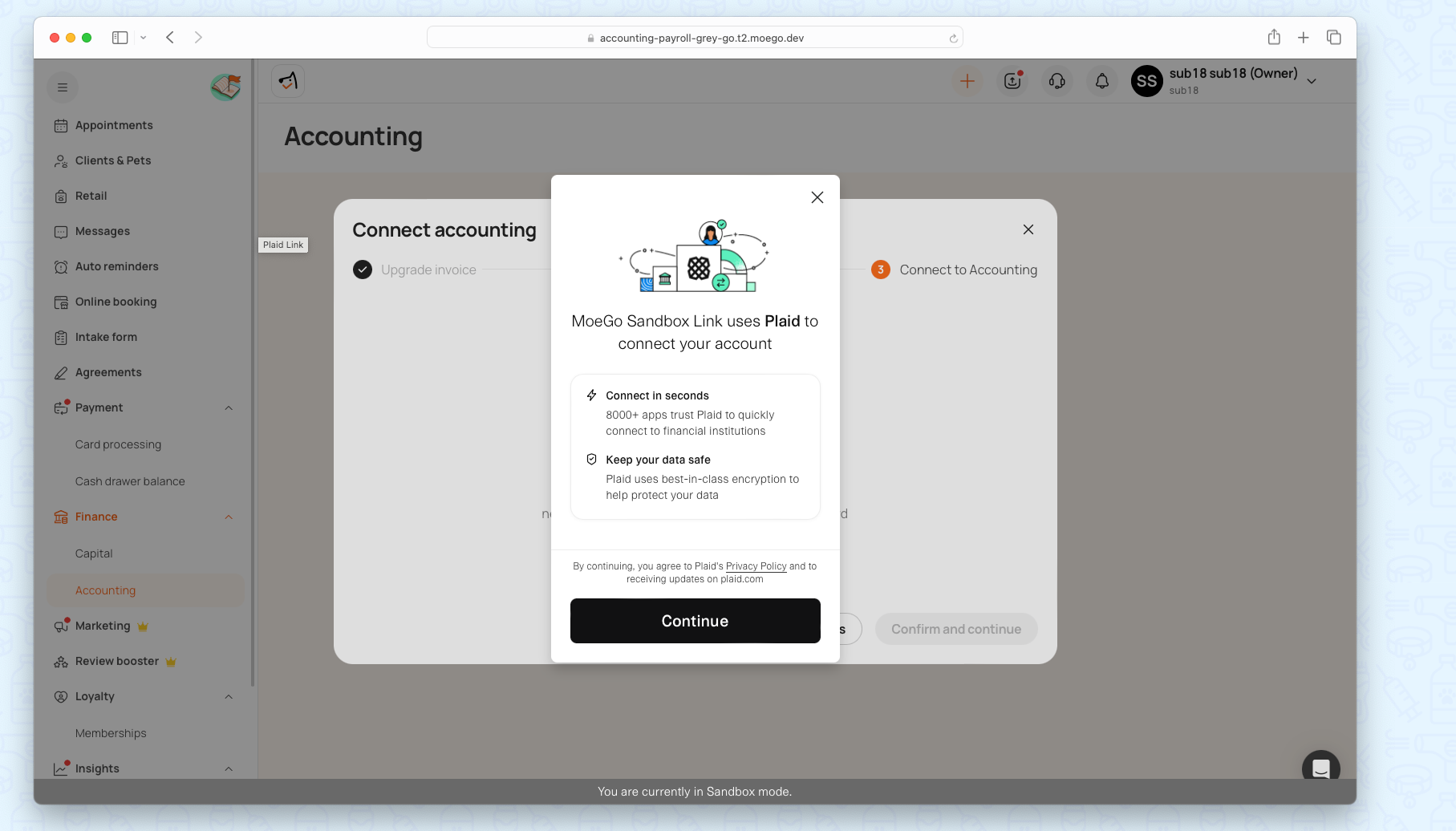

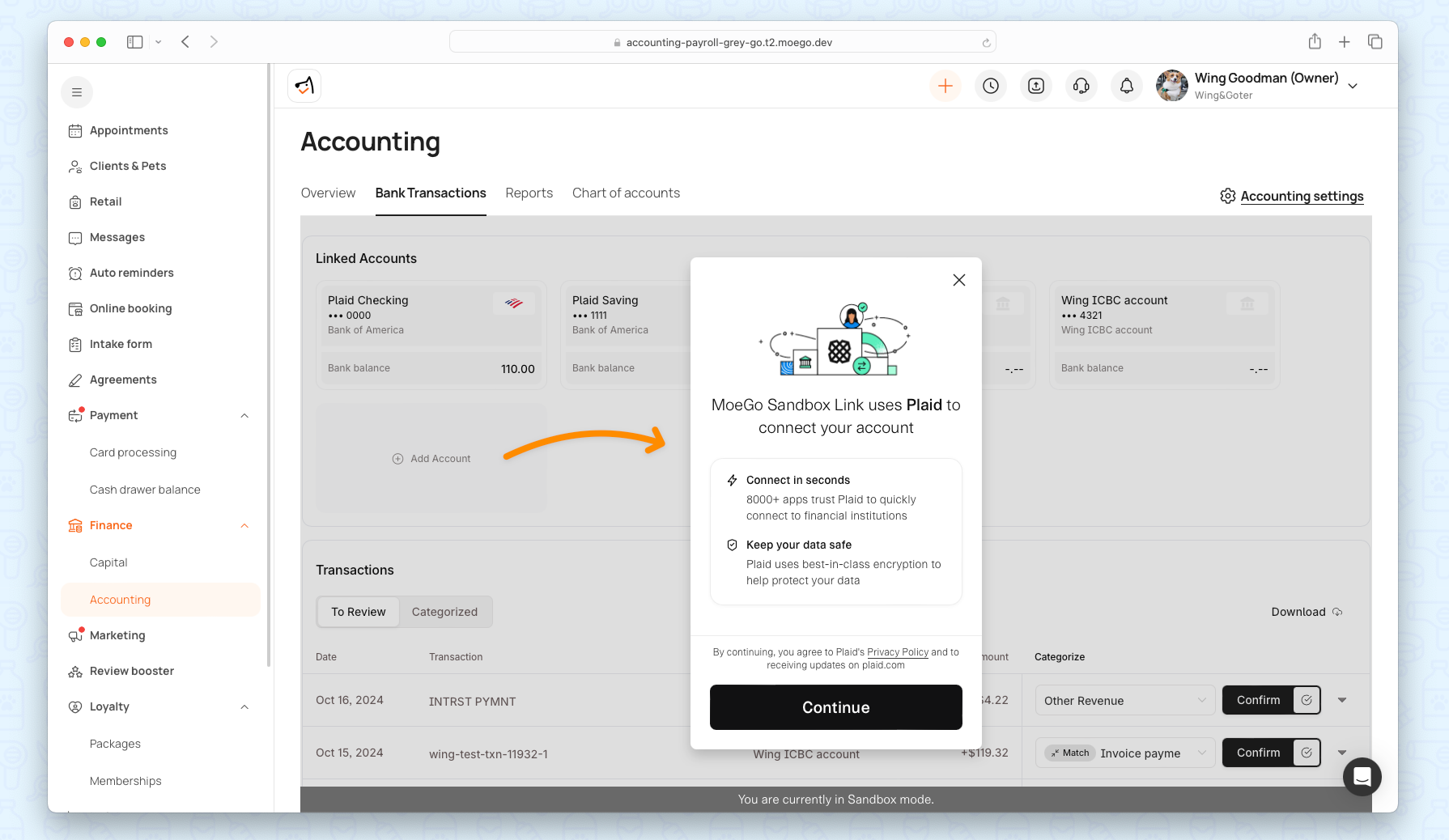

Step 3: Connect To Bank Account

You may need to connect your bank account and credit card, which allows MoeGo Accounting to automatically match invoice payments with your bank transactions, streamlining reconciliation.

You can enter your bank details or select from existing connected accounts to complete the setup.

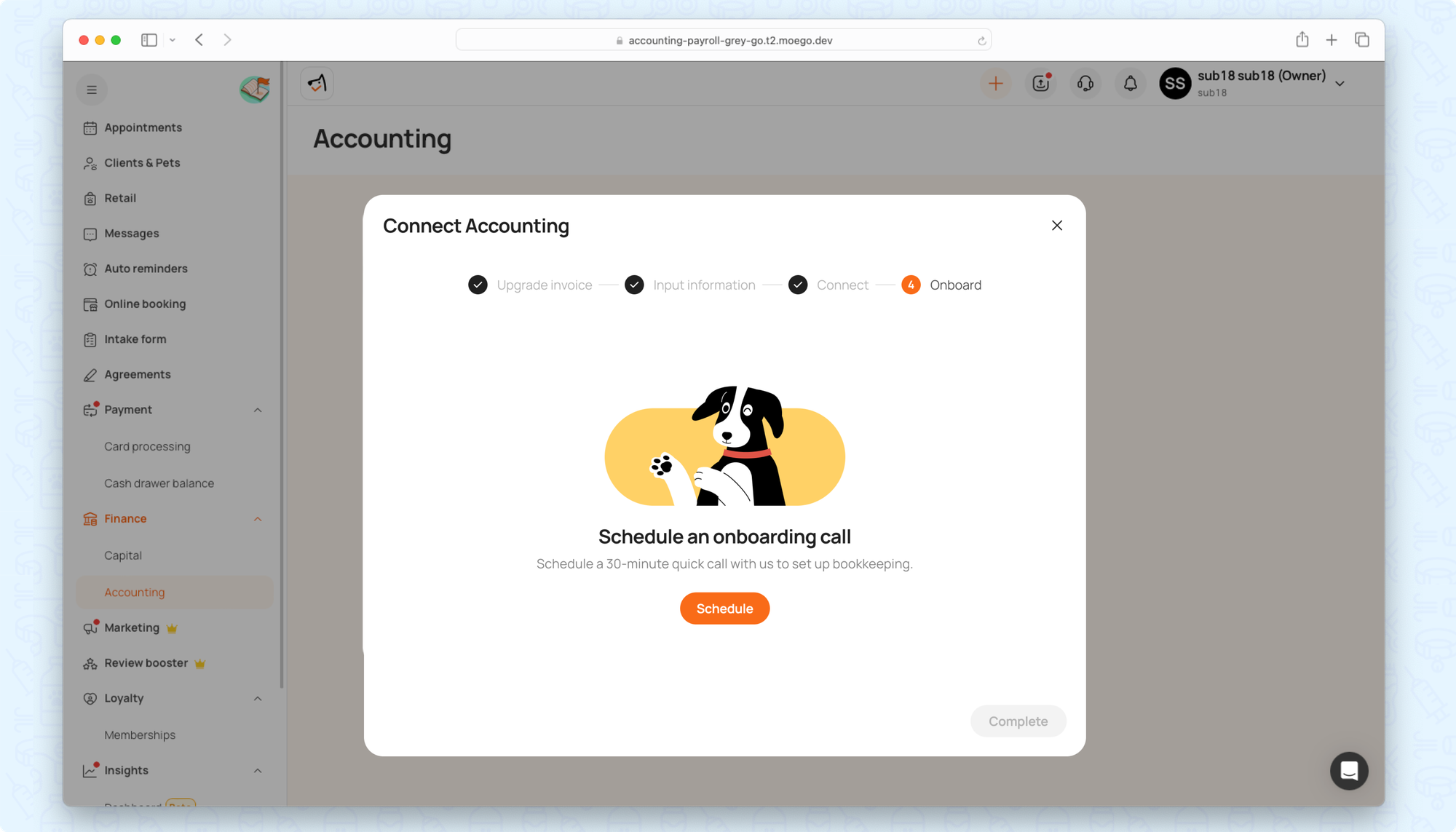

Step 4: Book a call for Bookkeeping Onboarding

*For Bookkeeping Service Only

Click on < Schedule > for a 30-minute onboarding call! Please select a date and time from the provided calendar to book a call with a MoeGo Bookkeeping specialist.

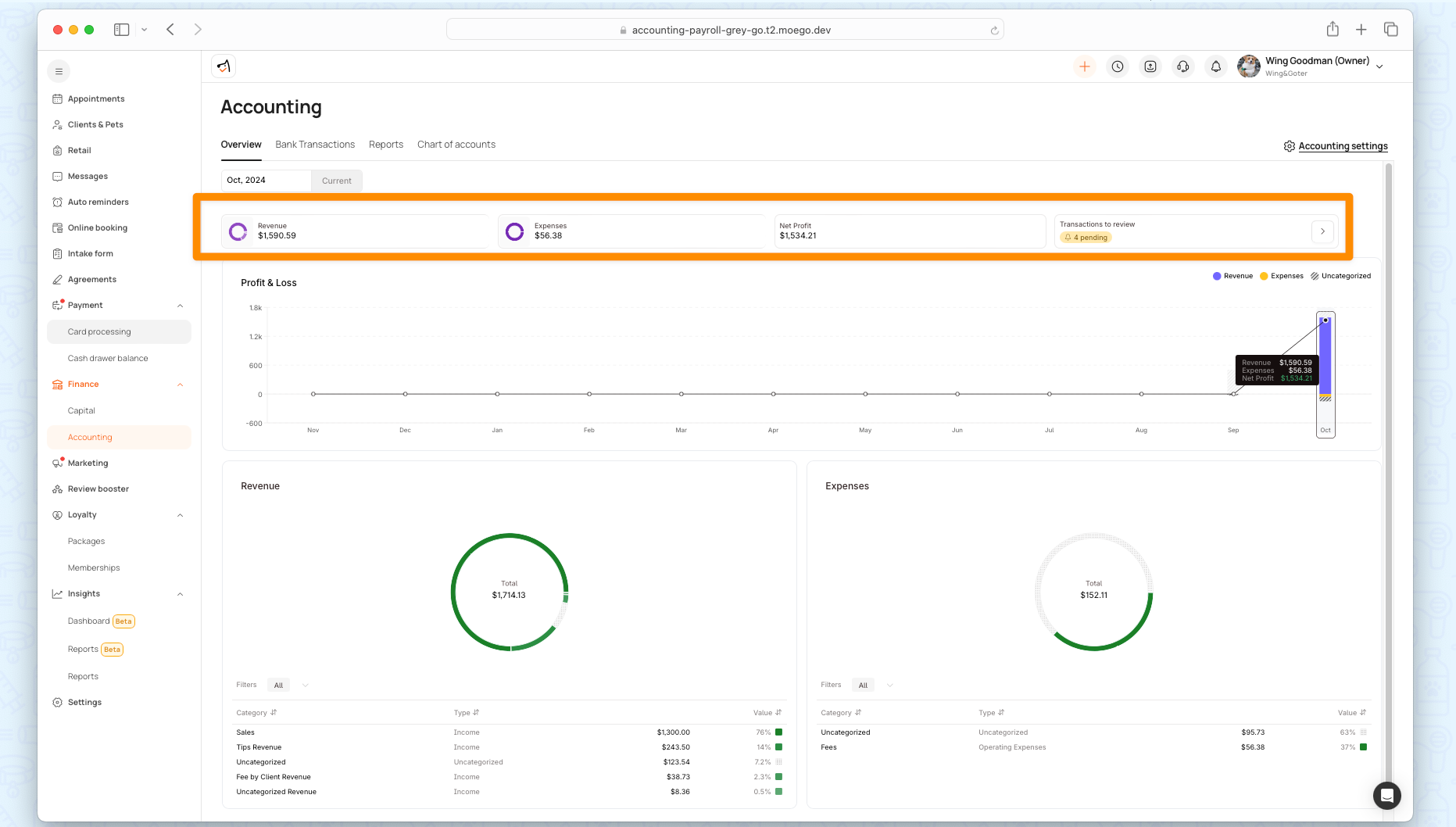

MoeGo Accounting Dashboard

The MoeGo Accounting dashboard provides a clear, comprehensive view of key financial metrics and insights.

Accounting Overview

The Overview tab offers a high-level summary of your financial performance. Here, you can adjust the date range to see financial metrics for a given period (e.g., monthly, quarterly, year-to-date).

- Revenue: Total income generated during the selected period.

- Expenses: Total outgoing costs for the period.

- Net Profit: The difference between revenue and expenses.

- Profit & Loss Chart: A visual representation of how revenue and expenses change over time.

*Example: Let’s say you’re reviewing finances for the current month. The Profit & Loss chart will show you how expenses for supplies might have spiked after a busy season or how revenue has grown steadily from customer referrals.

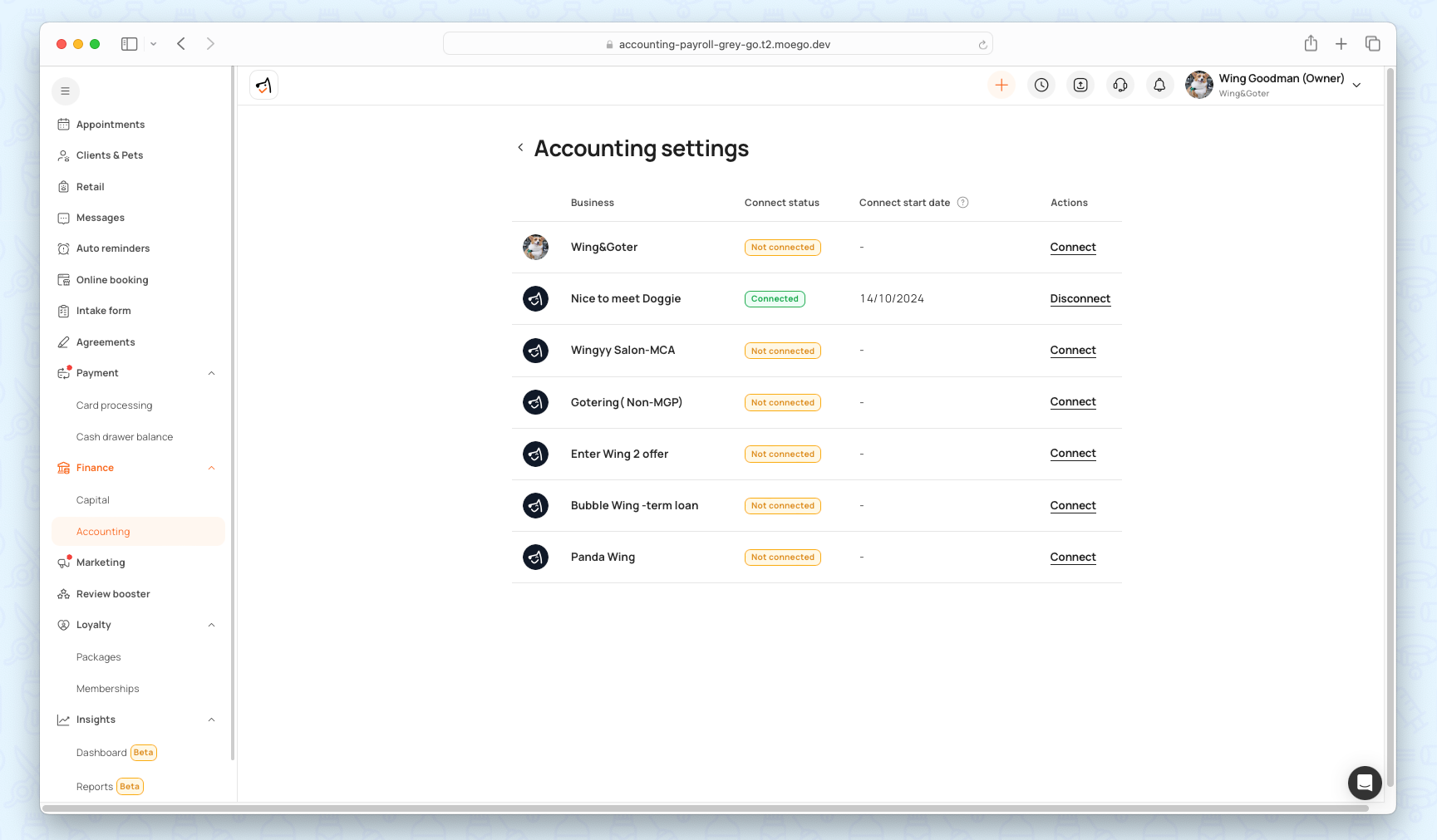

Accounting Settings

Go to Accounting Module > Overview > Accounting Settings. Here, you’ll find the options to connect or disconnect the business.

*Connect start date refers to the most recent date when the business connected to the Accounting Module.

Bank Transactions

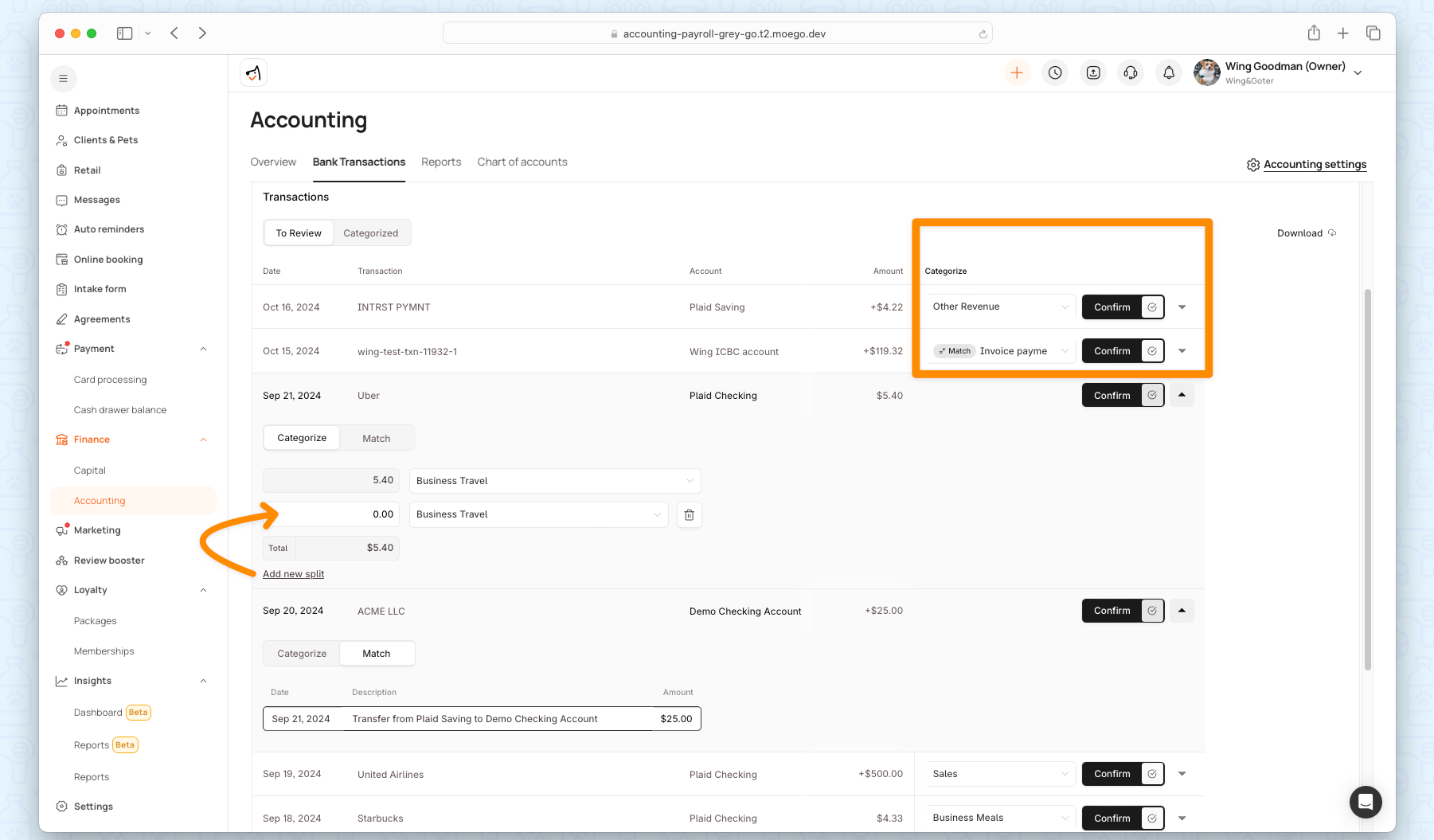

Review and reconcile all transactions from linked bank accounts. Any transactions that don’t match or need further review are flagged for easy identification.

Linked Accounts: MoeGo will automatically pull in transactions from the listed bank accounts for reconciliation. You can click "Add Account" to follow the prompts to link your bank securely.

Transactions to Review: You can see a summary of any unmatched or uncategorized transactions that need attention.

*MoeGo Accounting automatically matches your MoeGo invoice payments with corresponding bank transactions. If any transaction cannot be automatically matched, it will appear in the Transactions to Review section for manual confirmation.

Transactions categorized:

You can download all transactions with one click as well!

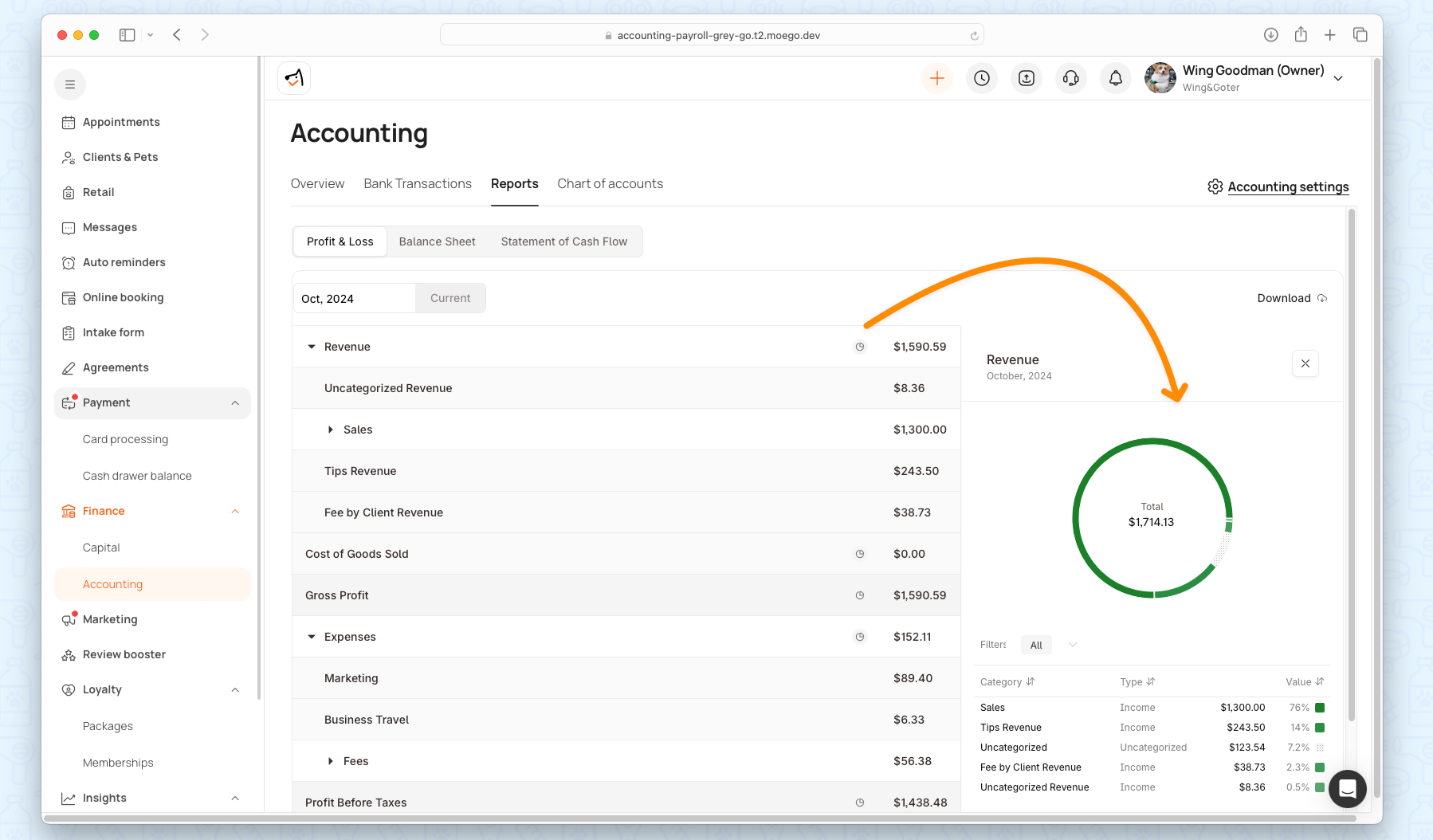

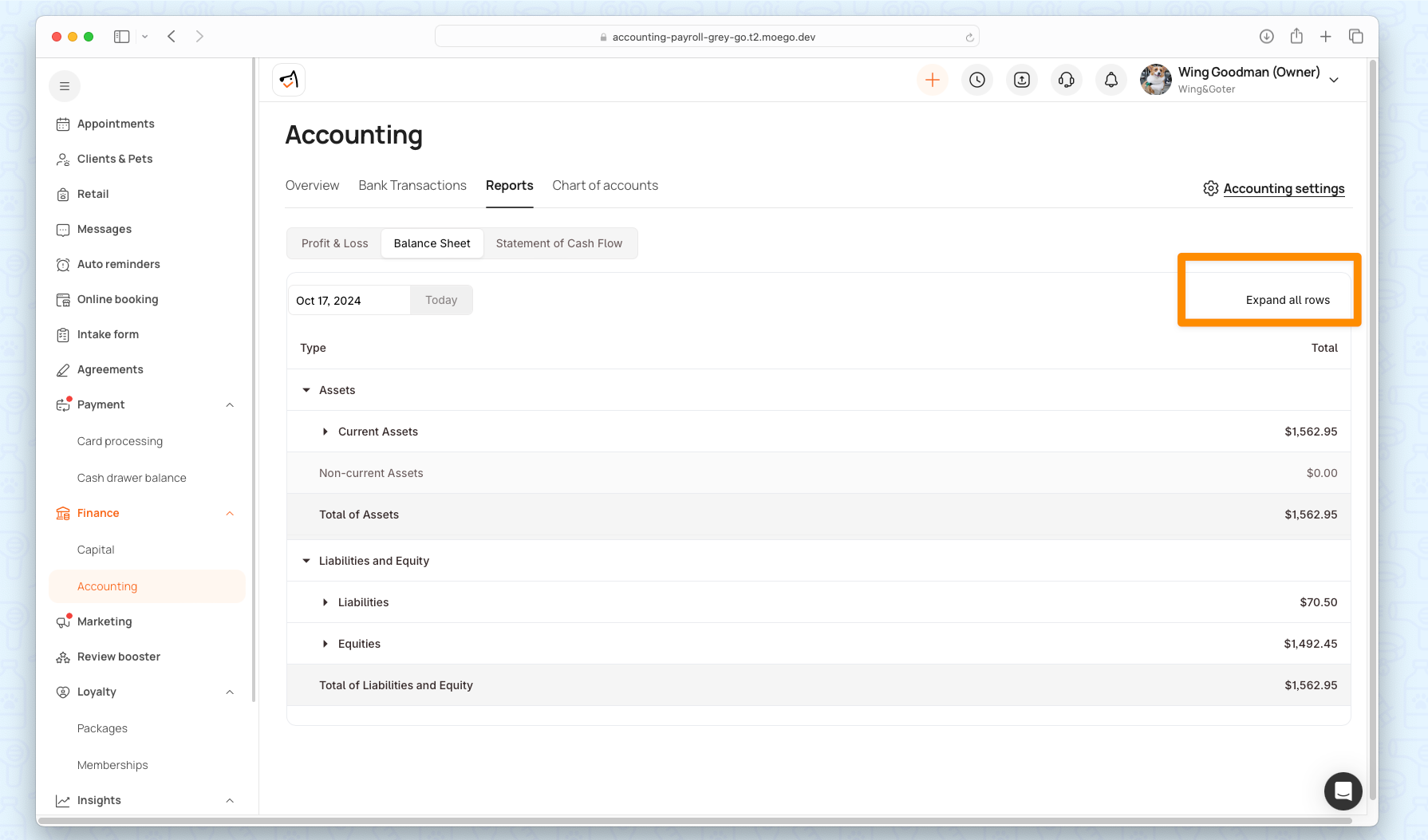

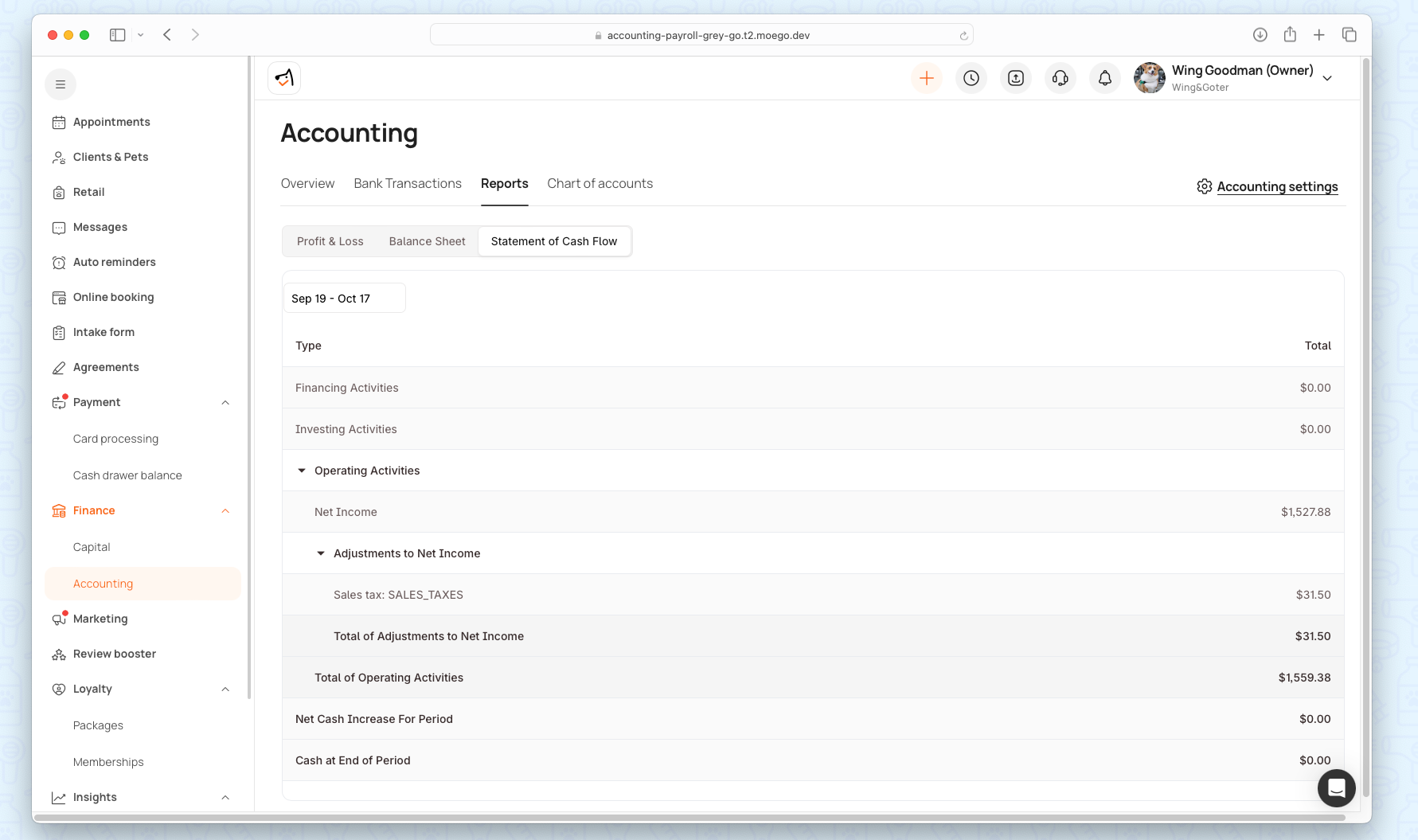

Reports

Provides access to standard financial reports for detailed analysis and compliance.

*You can customize the reporting period (e.g., monthly or quarterly) and download reports for further analysis or sharing with stakeholders.

Profit & Loss Reports: Breaks down revenue, expenses, and net profit over a specific period.

Balance Sheet: A snapshot of your business’s assets, liabilities, and equity.

Statement of Cash Flow: Tracks the movement of cash in and out of your business, providing a view of liquidity.

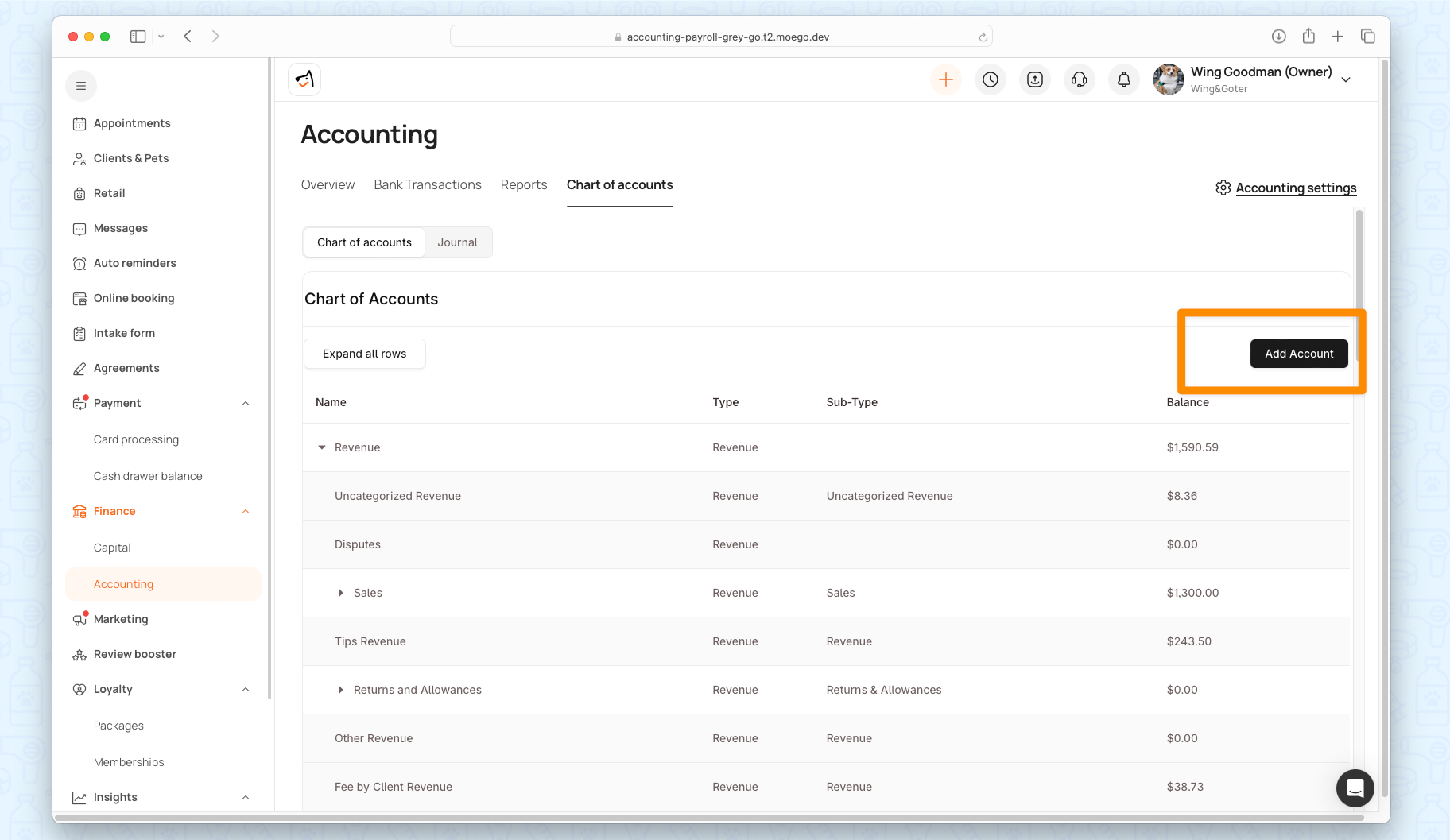

Chart Of Accounts

The Chart of Accounts organizes your transactions into standardized categories, ensuring consistent and accurate financial reporting.

Revenue (Service Revenue, Product Revenue, Tips)

Expenses (Payroll, Operating Expenses, Taxes)

Assets (Bank Accounts, Receivables)

Liabilities (Loans Payable, Payroll Payable)

Equity (Contributions, Retained Earnings)

Revenue Accounts

Revenue accounts represent the money a business earns from its core activities, like services or product sales. MoeGo divides revenue into several categories to show where your income is coming from.

Sales Revenue (Credit):

- Service Revenue: Income from grooming, boarding, daycare, or other pet services.

- Product Revenue: Income from retail items such as pet food, grooming supplies, or other products sold to customers.

- Package Revenue: Income from packages sold to clients, typically for services bundled together

- Evaluation Service Revenue: Income generated from Boarding & Daycare evaluation services, such as an initial pet assessment or behavioral evaluation, before the client engages in further services.

- Service Charge Revenue: Income from the service charge in the invoice

- No-Shows Account: No-show appointments where the client did not show up for a booked service, and the business chooses to record this as lost revenue or charge a penalty.

- Cancellation Fee Account: Cancellation fees are charged to customers who cancel their appointments within the penalty window.

Tips Revenue (Credit): Money received as tips, which is kept by the business instead of being distributed directly to staff.

Discounts (Debit): Any reductions or discounts given to customers. This is recorded as a debit because it reduces overall revenue.

Refunds (Debit): Returns or refunds issued to customers for both services and products:

- Service Refunds: Refunds for canceled or unsatisfactory services.

- Product Refunds: Refunds for returned products.

- Tips Refunds: Refunds specifically related to returned or corrected tips.

Expenses Account (Debit)

Expense accounts capture the costs the business incurs to operate. MoeGo provides detailed subcategories for a clearer view of where money is spent.

Taxes (Debit):

- Sales Tax: Tax collected and paid for product or service sales.

- Payroll Tax: Taxes related to employee payroll, such as Social Security or Medicare.

*Example: If you pay $2,000 in staff wages, this is recorded under Payroll Expenses. Similarly, sales tax collected from a customer is categorized under Sales Tax.

Processing Fees (Debit): Fees associated with payment processing, such as credit card or bank transfer fees.

Operating Expenses (Debit):

- Payroll Expenses: Basic salaries, bonuses, and wages for employees.

- Bad Debt: Amounts that are written off as uncollectible (e.g., overdue invoices that cannot be recovered).

Interest Expenses (Debit):

- MCA Interest Expenses: Interest on Merchant Cash Advances (MCA).

- Term Loan Interest Expenses: Interest paid on other business loans.

Loan Fee (Debit): Any fees associated with obtaining or maintaining a loan.

Assets Accounts (Debit)

Asset accounts represent items of value that the business owns. This can include receivables, bank balances, and other resources.

Accounts Receivable (Debit): Money owed by customers for unpaid invoices. (e.g., pending invoices).

Loan Receivable (Debit): Amounts the business has lent out that are expected to be repaid.

Clearing Accounts (Debit):

- Payment Clearing Account: A temporary holding account for payments before they are finalized and moved to the bank account.

- Cash and Bank Accounts (Debit): Actual cash in the business’s bank accounts, representing liquidity.

Liabilities (Credit)

Liability accounts to track money your business owes, whether it’s loans, payroll commitments, or other obligations

Loan Payable (Credit): Outstanding business loans.

- MCA Payable: Outstanding Merchant Cash Advances.

- Term Loan Payable: Other business loans that need to be repaid.

Payroll Payable (Credit): Salaries and wages owed to employees but not yet paid.

Tax Payable (Credit): Taxes owed but not yet paid.

Tips Liability (Credit): Tips held by the business that need to be distributed to employees in the future.

Equity (Credit):

Equity represents the ownership value in the business after all liabilities have been deducted from assets. It shows the net worth of the business.

Contributions (Credit): Represents the total investment and ownership capital held by the business owners.

Retained Earnings (Credit): Profits that have been reinvested in the business rather than distributed to owners. This might include previous years’ undistributed earnings.

Adding & Managing Accounts:

You can add new categories to customize the financial tracking.

You are free to customize accounts to better suit your business needs. This flexibility ensures that you can tailor MoeGo Accounting to your specific operations, whether it’s adding new revenue sources or expense categories.

Frequently Asked Question

Q: Does MoeGo offer bookkeeping services?

A. Yes, MoeGo provides full-service bookkeeping in addition to automated accounting features. We offer access to professional bookkeepers who can manage your books, ensure accurate financial reporting, and assist with tax preparation. This service allows you to focus on growing your business while we handle the detailed accounting work. If you need dedicated bookkeeping support, our team can handle tasks such as:

- Transaction categorization and reconciliation

- Generating custom reports (e.g., Profit & Loss, Balance Sheet)

- Ensuring compliance with tax regulations

- Ongoing financial oversight

Q: How do I migrate my QuickBooks data to MoeGo Accounting for the Beta program?

A: To migrate your QuickBooks data into MoeGo Accounting, follow these steps by granting MoeGo access as an Accounting Firm in QuickBooks:

- Log into QuickBooks: Sign in to your QuickBooks account.

- Navigate to Manage Users: In the upper right corner, click Settings (gear icon). From the dropdown menu, select Manage Users.

- Add MoeGo as an Accounting Firm: Scroll down to the Accounting Firms section. Then click Invite to add a new Accounting Firm.

- Enter MoeGo’s Details: Fill in the following information to invite MoeGo to access your QuickBooks data:

- First Name: MoeGo

- Last Name: Accounting

- Email: moego-accounting@layerfi.com

- Save and Confirm: Click Save to send the invitation to MoeGo.

Q: What types of transactions does MoeGo Accounting automatically categorize?

A: MoeGo Accounting automatically categorizes a variety of transactions. These transactions are categorized based on standard accounting practices into a predefined Chart of Accounts:

- Service Revenue (e.g., grooming, daycare, evaluation services)

- Product Revenue (e.g., retail products)

- Refunds (for services and products)

- Expenses (e.g., taxes and processing fees)

Q: What types of reports are available in MoeGo Accounting?

A: MoeGo Accounting provides standard financial reports that help you analyze the financial health of your business and can be customized by date range:

- Profit & Loss Statement: Overview of your revenue, expenses, and profit.

- Balance Sheet: Snapshot of your assets, liabilities, and equity.

- Statement of Cash Flow: This shows how cash is moving in and out of your business.

Q: How do I reconcile my bank transactions with MoeGo invoices?

Reconciliation is done automatically through MoeGo Accounting by matching bank transactions with invoice payments. If any transactions need manual review, they will be flagged in the To Review section under Bank Transactions. You can manually categorize and confirm unmatched transactions to complete the reconciliation process.

Q: Can I use MoeGo Accounting for tax preparation?

A: Yes, MoeGo Accounting simplifies tax preparation by organizing your transactions according to standard accounting categories, such as Revenue, Expenses, and Taxes Payable. You can easily generate reports to assist with filing taxes, and your accounting data is prepared in a way that meets compliance requirements.

Q: Can I use MoeGo Accounting for multiple business locations?

A: Yes, MoeGo Accounting supports syncing data from multiple locations within one company. During the setup process, you can select which business locations you want to connect to the accounting module, and MoeGo will manage the finances as one company.

Q: What happens if I cancel my MoeGo Accounting subscription?

A: Once canceled, you may no longer have access to the accounting features, including transaction categorization, bank reconciliation, and financial reports. However, your previous accounting data will remain accessible, and you can export reports before canceling if needed.

Feel free to reach out to MoeGo Support if you have further questions.