This is on Closed Beta: Enrollment is by invitation only.

The Advanced Deposit Feature in MoeGo allows businesses to collect deposits with precision and flexibility—either manually or through automated rules. With support for item-level attribution, deposits are clearly tied to services on the invoice, enhancing financial transparency and reducing the risk of no-shows.

Key Benefits

- Business-Level Control: Set deposit rules globally, with support for location-specific settings.

- Automated Enforcement: Deposit rules apply to both staff-created and online bookings.

- Smart Rule Prioritization: If multiple rules apply, the system enforces the one requiring the highest deposit.

- No-Show Protection: Retain deposits for no-shows to protect revenue.

- Transparent Reporting: View deposit collections, refunds, and forfeitures via audit logs linked to invoices.

Manual Deposit Collection

Use when: You want to customize deposits per client or service.

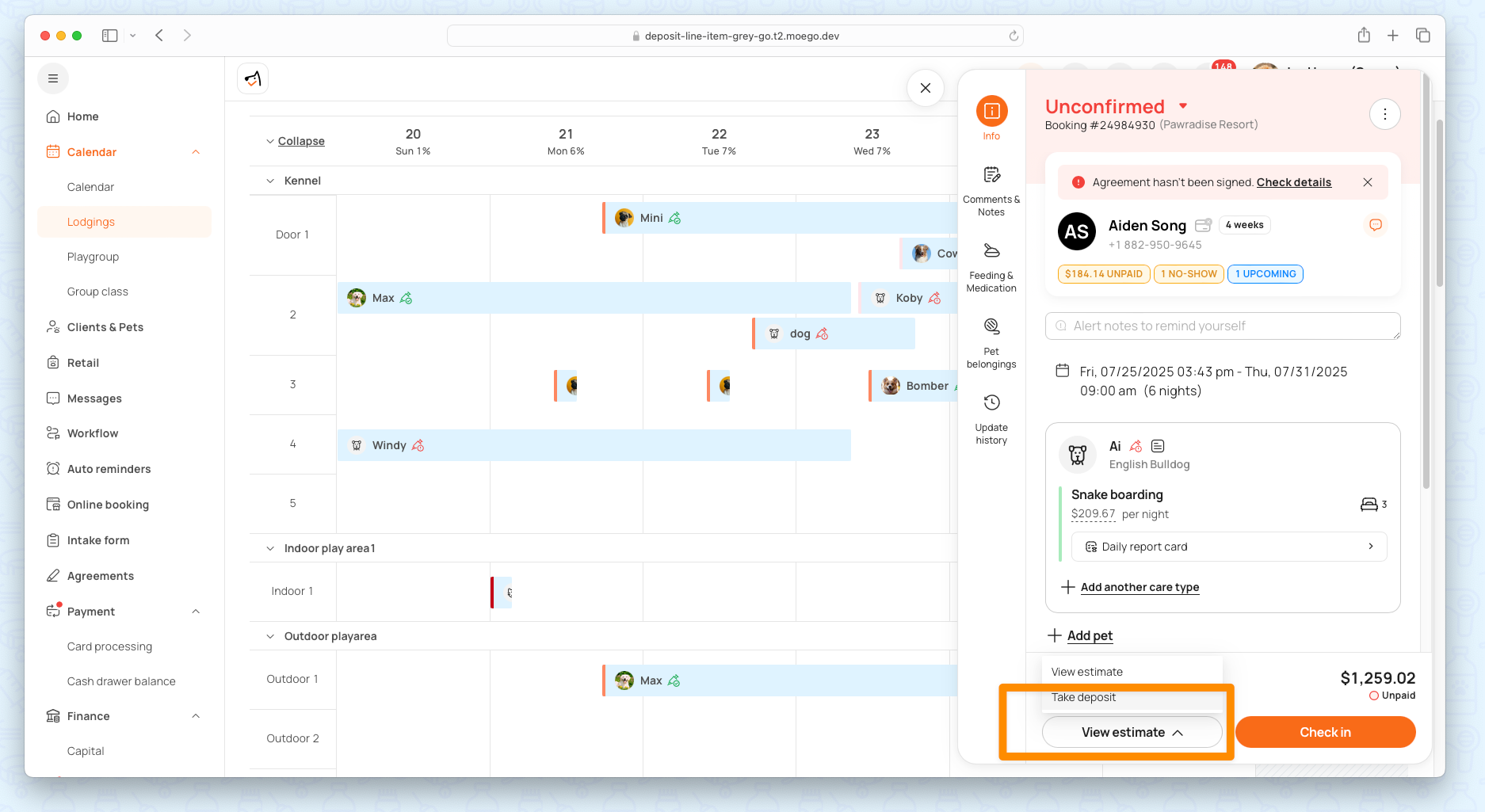

How to take manual deposits: Go to appointment details > View Estimate > Take deposit.

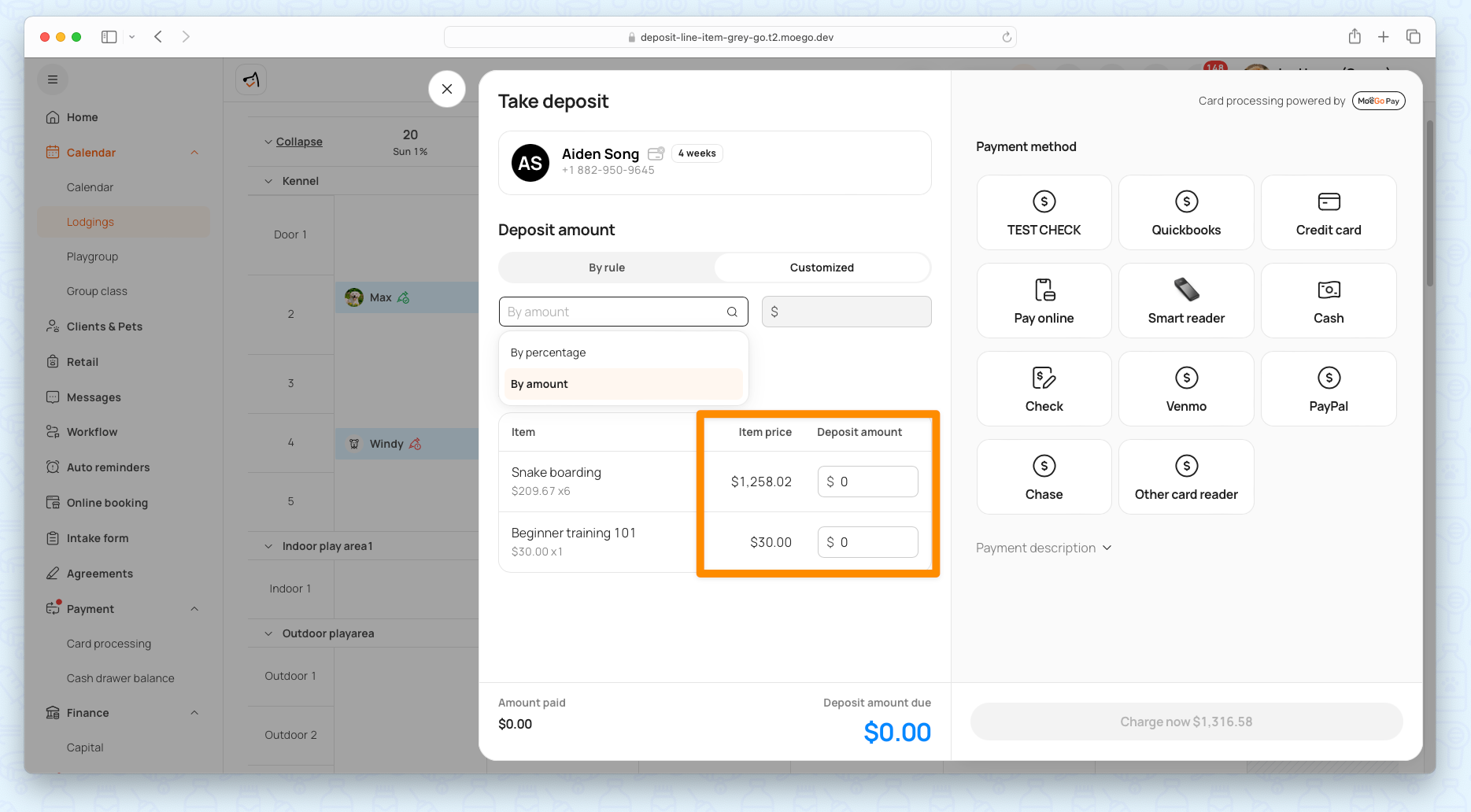

Choose between:

- Fixed amount

- Percentage of service total

Automated Deposit Rules

Use when: You want to enforce consistent deposit requirements based on service, date, or client type.

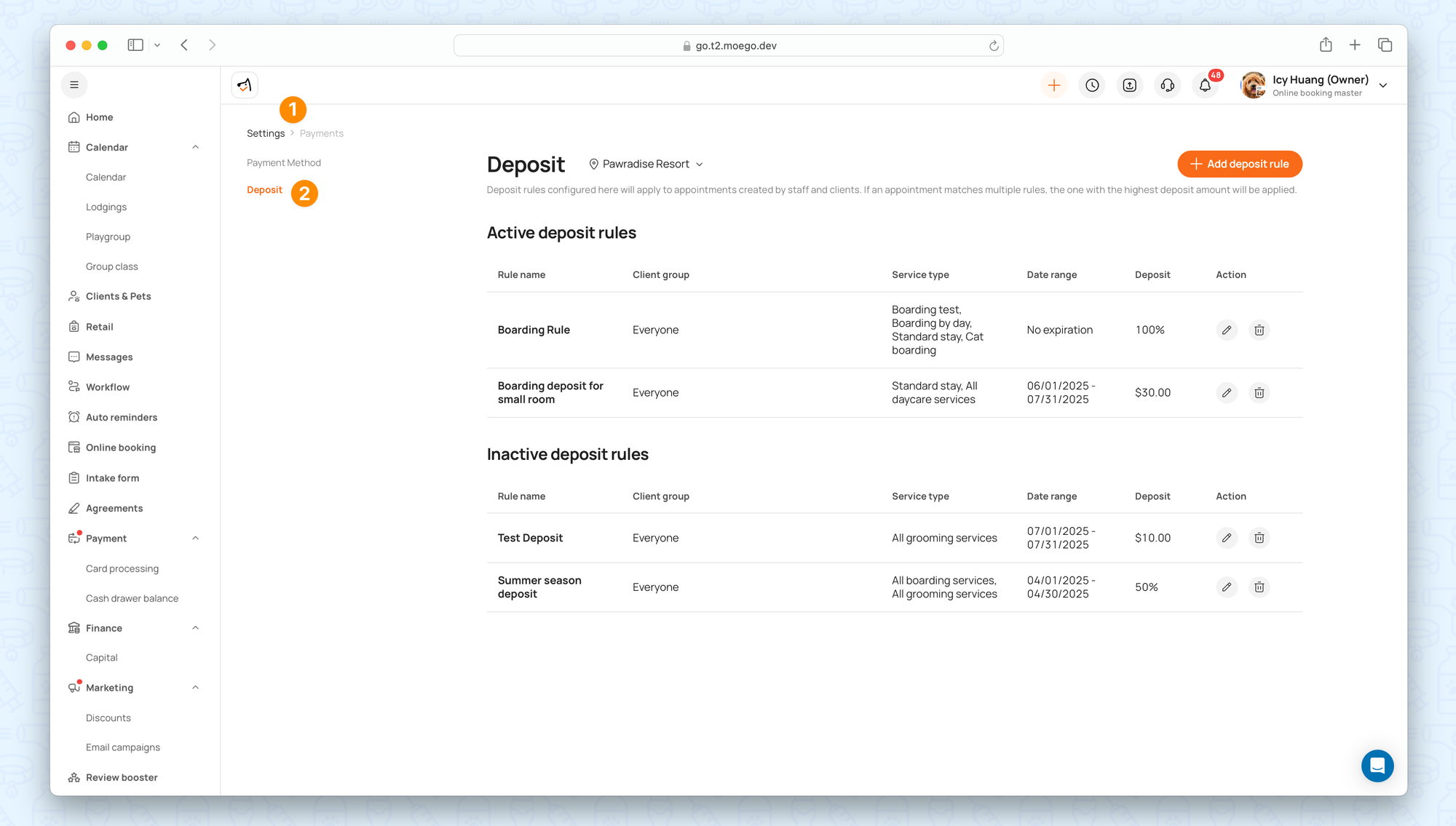

Set up deposit rules: Navigate to Settings > Payments > Deposit to set up deposit rules.

Creating new deposit rules

Click < + Add Deposit Rule > to configure a new rule.

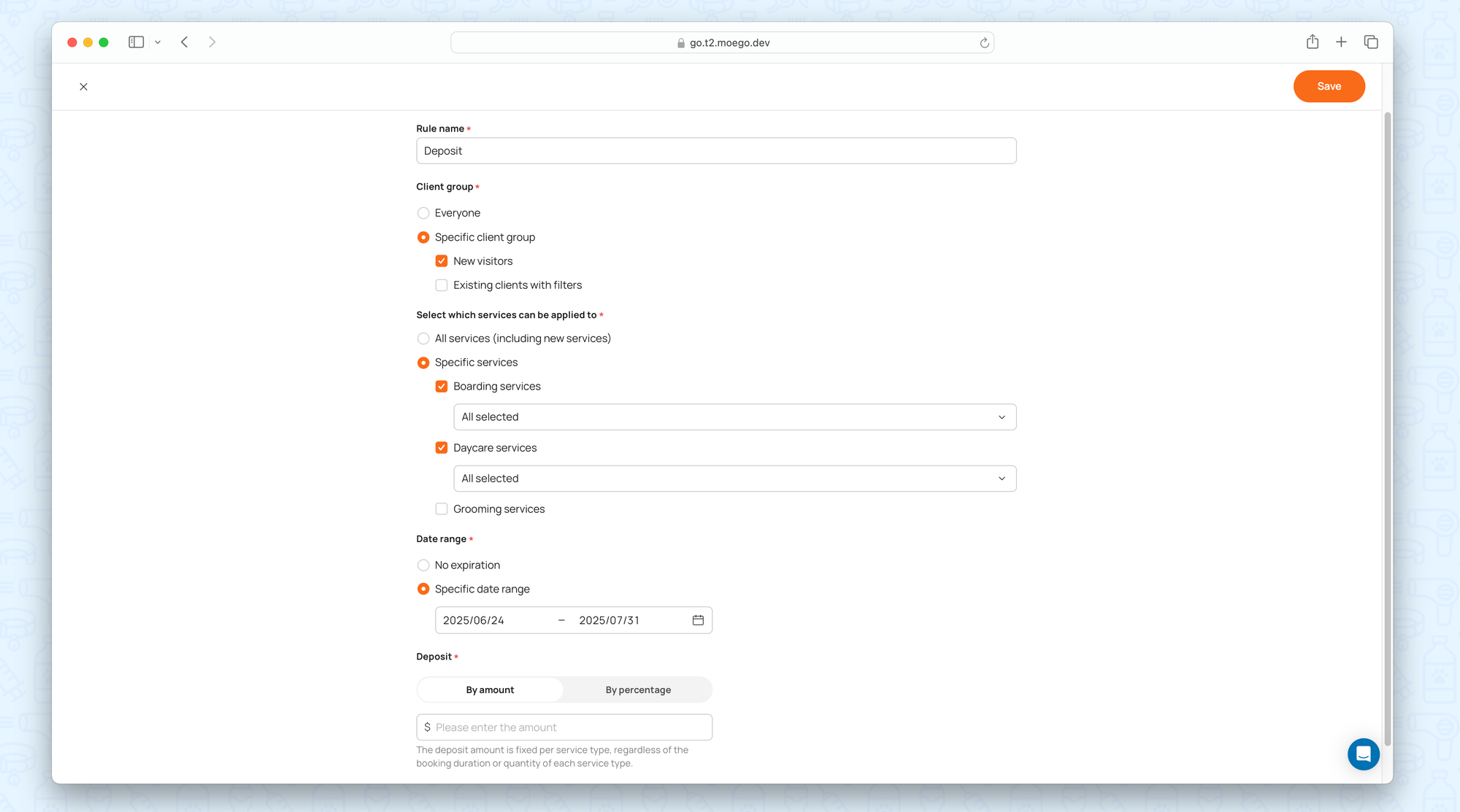

- Rule Name: Visible on the invoice.

- Client Group: All clients, new visitors, or existing clients (with filters).

- Service Range: All services or selected ones.

- Date Range: Define when the rule is active (based on appointment start date)

- Deposit Method:

- By Amount – Fixed deposit per service

- By Percentage – % of the service total

💡 Note: Rules automatically expire after the defined date range.

Deposit Collection in Action

Quick Charge for New Appointments

- When creating an appointment that matches deposit rules, the "Charge Deposit" window appears automatically.

- Workflow: New Appointment > Save > Charge Deposit.

- Use Case: Ensures front desk collects required deposits at the time of booking.

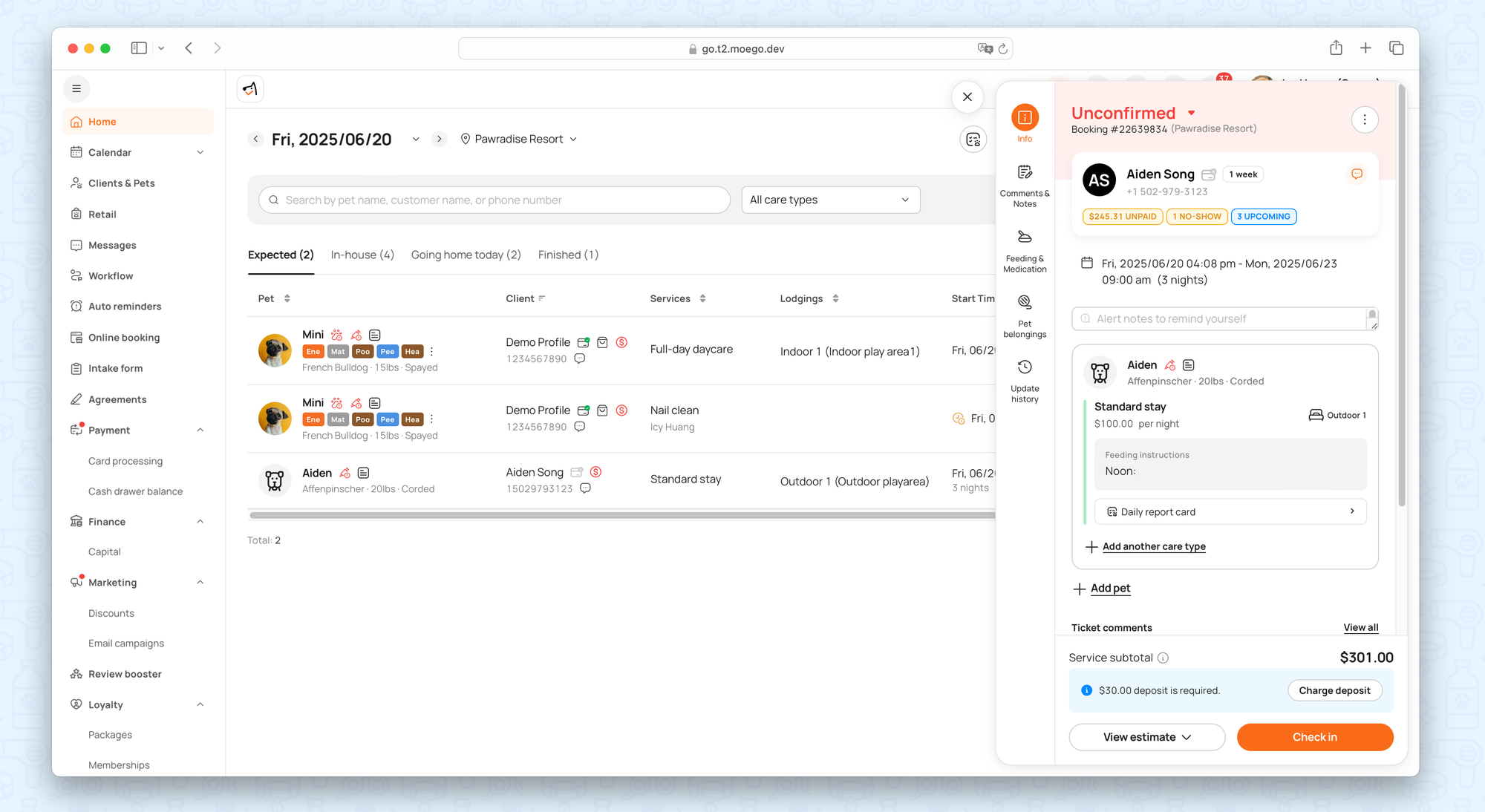

Reminder for Existing Appointments

- If an appointment has an unpaid deposit, a blue banner appears.

- Workflow: Appointment Details > Charge Deposit.

- Use Case: Ideal for daily deposit collection reviews or sending invoices later.

Managing Deposits After Booking

Auto-Confirm Upon Payment

- When a deposit is paid: Appointment status updates to Confirmed automatically.

- Workflow: Deposit Paid → Appointment Status Updates to "Confirmed".

- Use Case: Reduces manual work and secures the booking instantly for online clients.

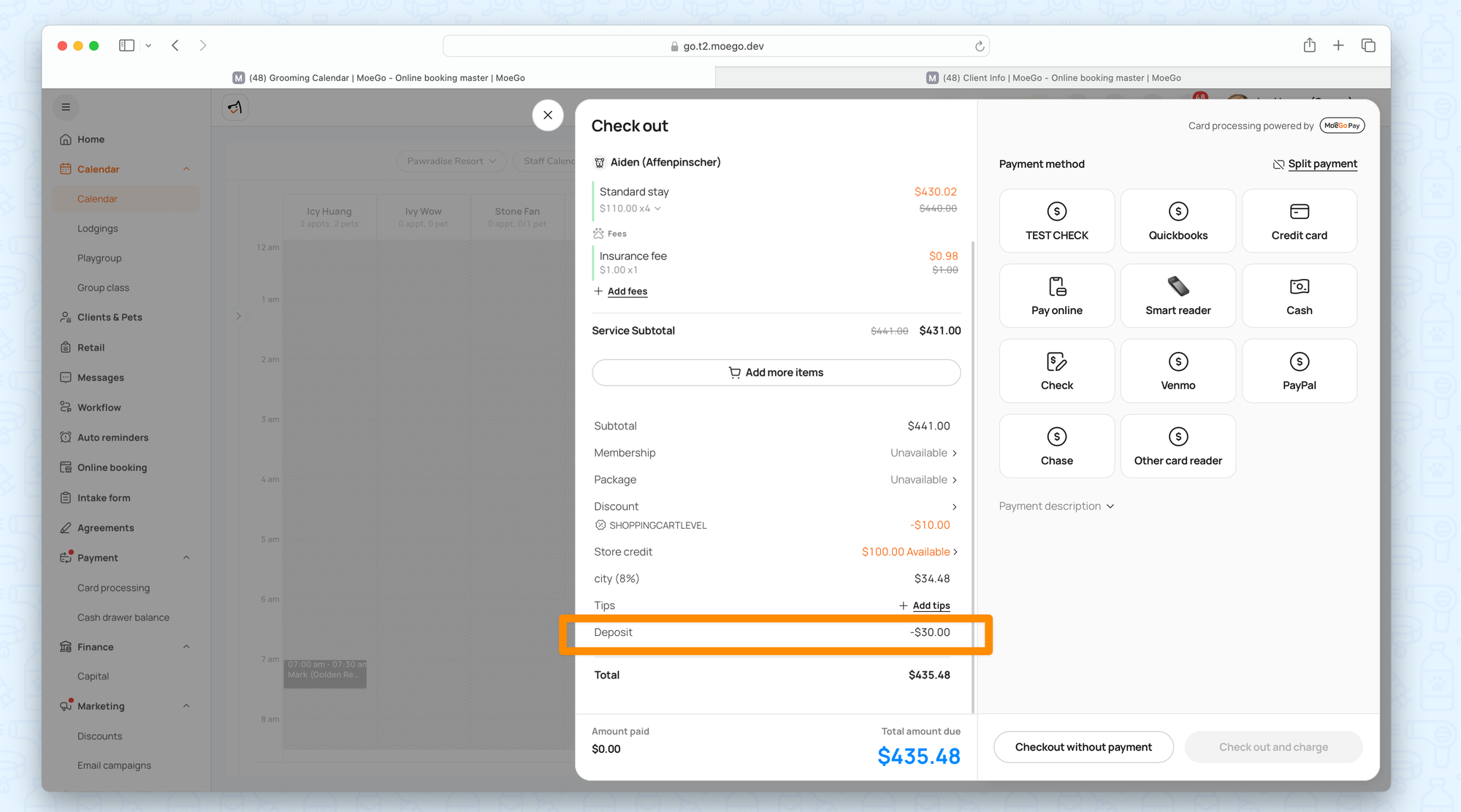

Checkout: Apply Deposit Automatically

- Deposit is automatically deducted from the invoice.

- Remaining balance is clearly shown.

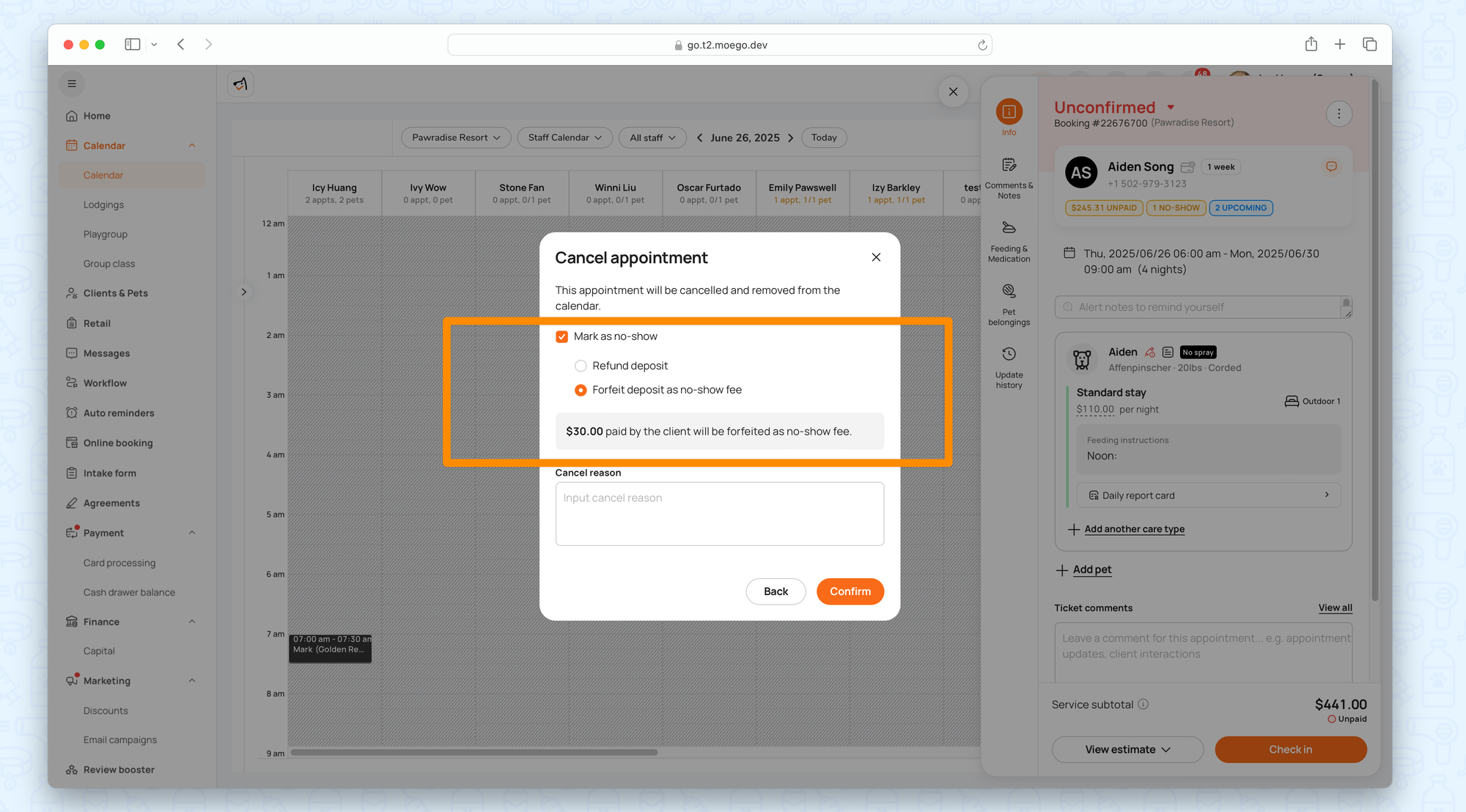

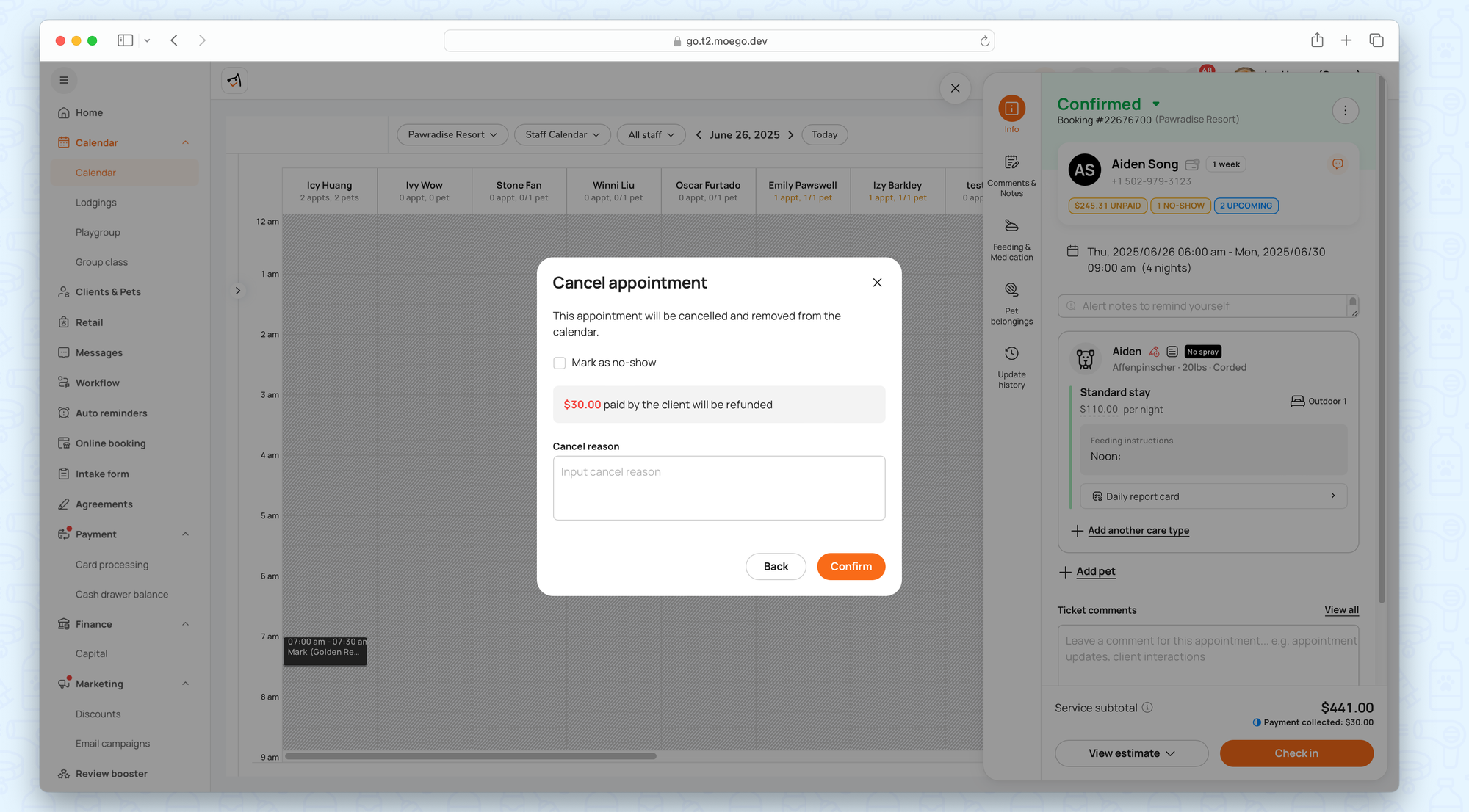

Handling Cancellations and No-Shows

- Forfeit Deposit as No-Show Fee, ensuring accurate reporting and revenue protection.

- Workflow: Appointment Details > Cancel > Mark as No-Show > Forfeit Deposit.

- Use Case: A client cancels last-minute; the business retains the deposit per policy.

💡Note: If an appointment is canceled without marking as a no-show, the deposit is automatically refunded.

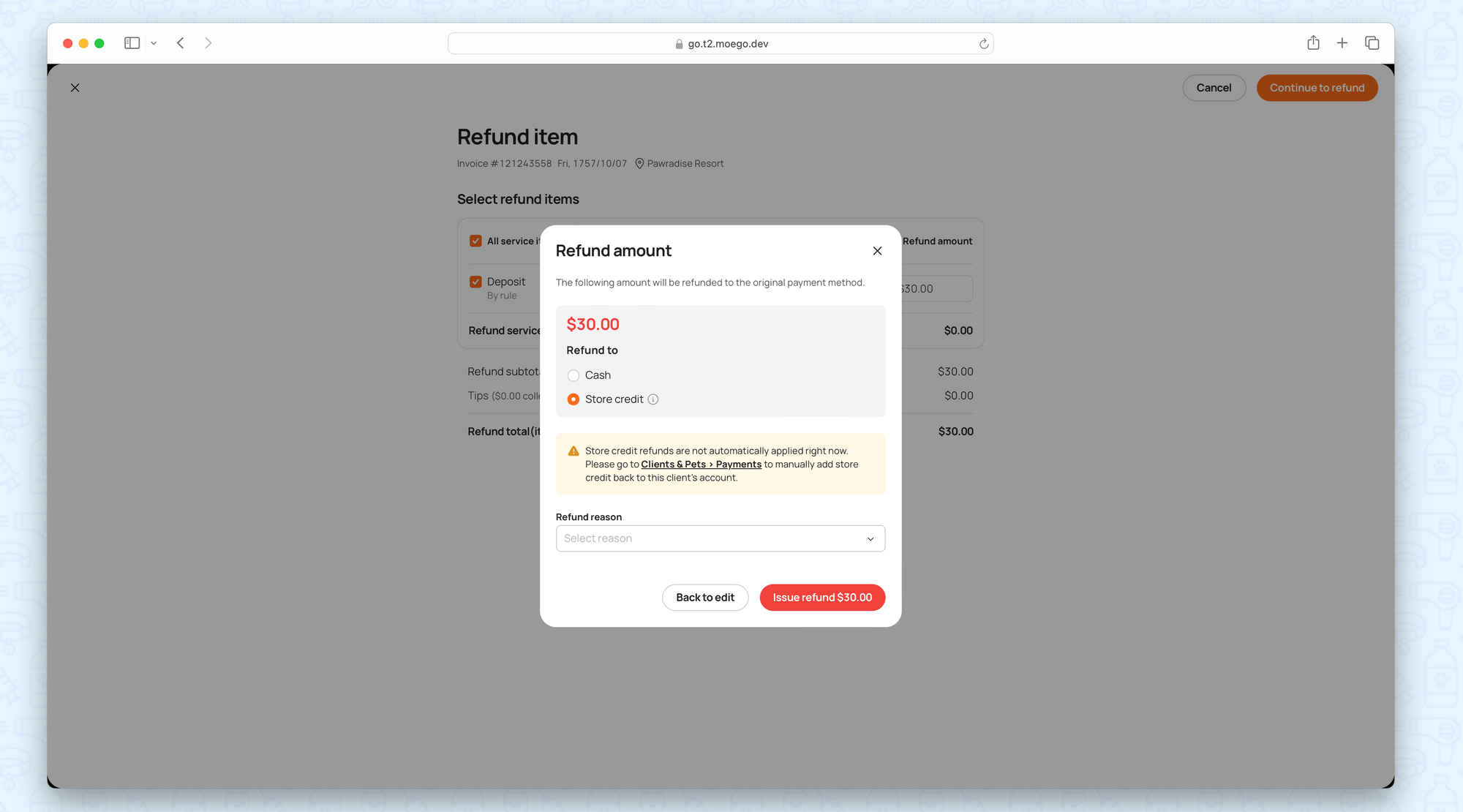

Refunds as Store Credit

- You can offer store credit instead of a cash refund.

- Workflow: Appointment Details > View Receipts > Refund Deposit > Refund to Credits.

- Use Case: A client prefers credit for future visits instead of a cash refund.

💡Note: The deposit can only be refunded as credits for cash payment.

💡Note: Once refunded, it will be saved as records only for the report.

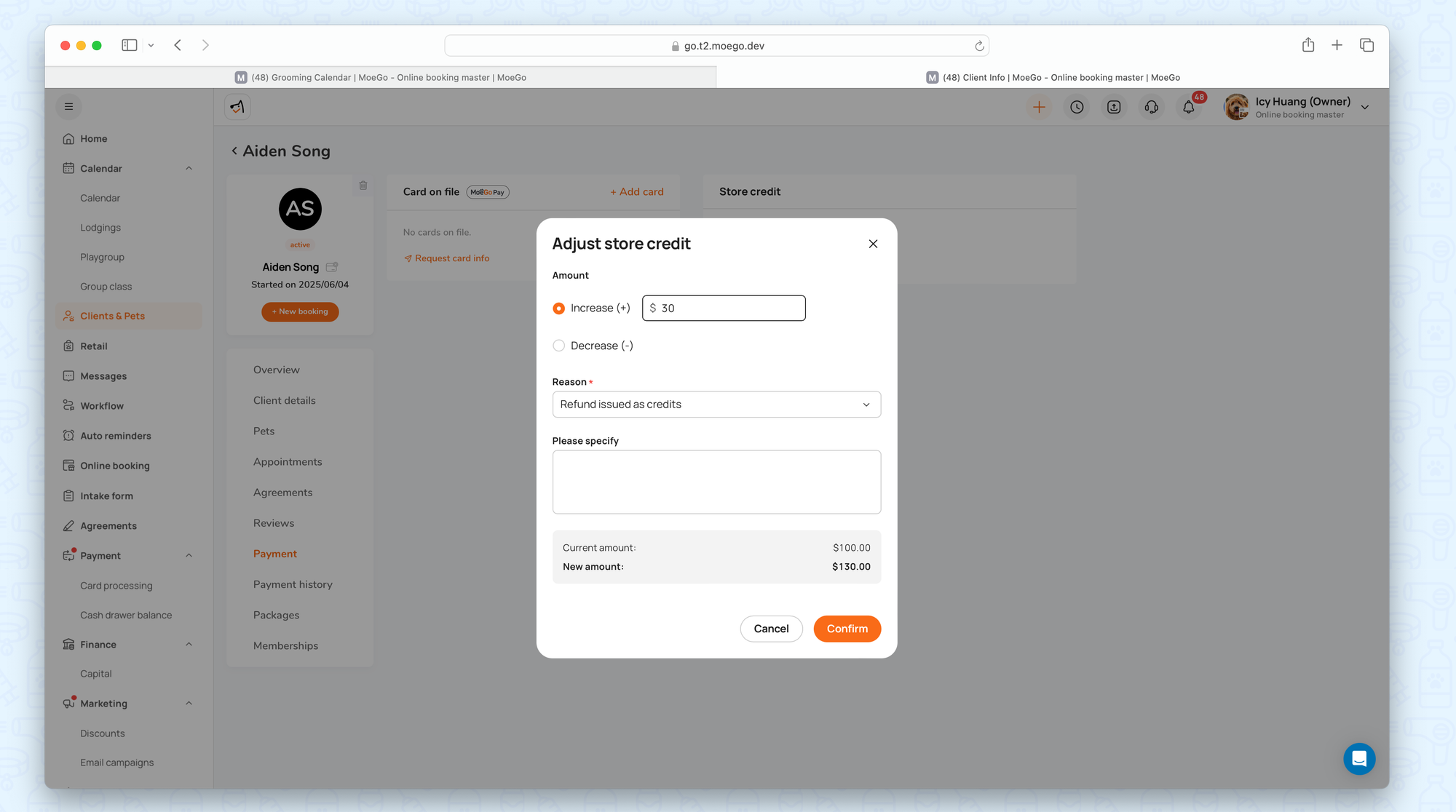

Currently, store credit must be manually applied at checkout via Client Profile > Payments. (Auto-application is in development.)

For more details, please refer to: MoeGo Store Credit (Beta) - Client Balances for Loyalty & Revenue

FAQ

Q: Are deposits tracked in reports?

A: Yes. Deposit collections, refunds, and forfeitures are logged in Deposit Audit Reports, linked to their source invoices.